How to Choose Profitable Cryptocurrencies for Trading

How to Choose Profitable Cryptocurrencies for Trading

How to Choose Profitable Cryptocurrencies for Trading

Are you ready to unlock the secrets of the cryptocurrency market and make informed trading decisions? With the vast array of digital assets available, selecting the right cryptocurrencies can be a daunting task.

Choosing the right cryptocurrencies for trading requires a deep understanding of market trends and the factors that influence their profit potential. As the cryptocurrency landscape continues to evolve, it’s essential to stay ahead of the curve and identify the most promising opportunities.

In this article, we’ll explore the key considerations for selecting profitable cryptocurrencies, providing you with the insights needed to maximize your returns in the ever-changing world of crypto trading.

Key Takeaways

- Understand the factors that influence cryptocurrency profitability

- Learn how to analyze market trends and make informed trading decisions

- Discover the key characteristics of profitable cryptocurrencies

- Stay ahead of the curve with the latest insights on crypto trading

- Maximize your returns with a data-driven approach to cryptocurrency selection

Understanding the Cryptocurrency Market Landscape

The cryptocurrency market’s ever-changing landscape demands a comprehensive understanding of market capitalization, trading volume, and volatility. To navigate this complex environment, traders must be aware of the factors that influence cryptocurrency profitability.

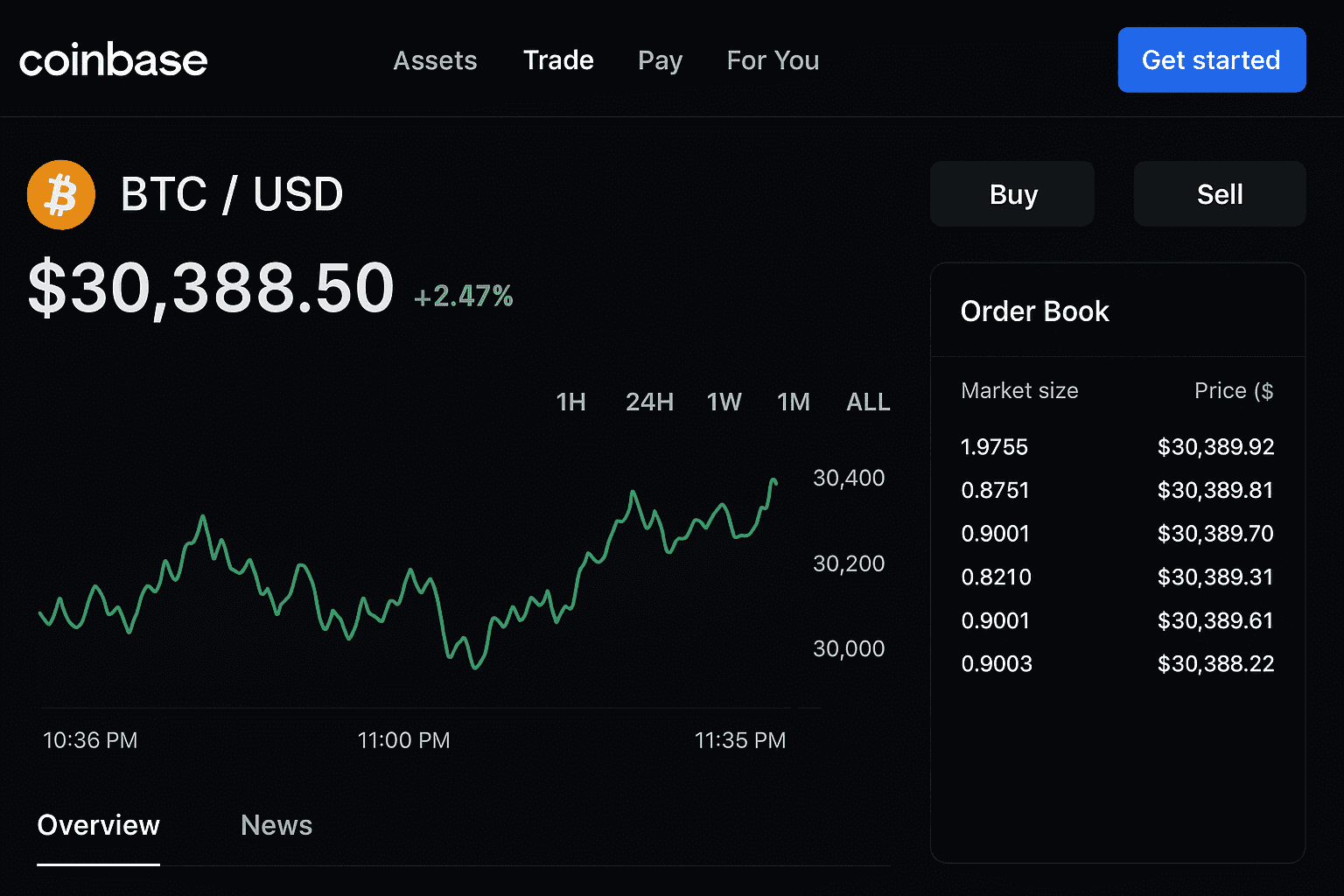

Market Capitalization and Trading Volume

Market capitalization and trading volume are crucial indicators of a cryptocurrency’s market presence. Market capitalization represents the total value of a cryptocurrency’s circulating supply, while trading volume indicates the amount of buying and selling activity.

Interpreting Market Cap Rankings

Market capitalization rankings provide insight into a cryptocurrency’s relative size and stability. The top cryptocurrencies by market capitalization are generally considered to be more stable and less volatile.

Volume as an Indicator of Liquidity

Trading volume is a key indicator of liquidity, with higher volumes indicating a more liquid market. This is essential for traders, as it affects their ability to buy or sell a cryptocurrency quickly and at a fair price.

Market Cycles and Volatility

Cryptocurrency markets are known for their volatility, with prices often experiencing significant fluctuations. Understanding market cycles and being prepared for potential downturns is crucial for managing risk.

Cryptocurrency Categories and Ecosystems

The cryptocurrency space encompasses various categories, including DeFi tokens, layer-1 blockchains, and NFTs. Each category has its unique characteristics and market dynamics, offering diverse opportunities for traders.

- DeFi tokens are associated with decentralized finance projects.

- Layer-1 blockchains are foundational protocols like Bitcoin and Ethereum.

- NFTs represent unique digital assets, often used in art and collectibles.

Key Factors That Influence Cryptocurrency Profitability

The value and profitability of cryptocurrencies are affected by several significant factors. Understanding these elements is crucial for investors looking to navigate the complex cryptocurrency market.

Supply and Demand Dynamics

Supply and demand dynamics play a critical role in determining the profitability of cryptocurrencies. The balance between the available supply of a cryptocurrency and the demand for it can significantly impact its value.

Circulating Supply vs. Total Supply

The circulating supply of a cryptocurrency refers to the number of coins or tokens that are currently available for trading. In contrast, the total supply includes all coins or tokens that have been mined or created, regardless of whether they are actively being traded.

Token Burning and Deflationary Models

Token burning involves permanently removing a certain number of tokens from circulation, which can help increase the value of the remaining tokens by reducing supply. Deflationary models, which incorporate mechanisms like token burning, are designed to counteract inflationary pressures by reducing the total supply over time.

Adoption Rate and Real-World Utility

The adoption rate of a cryptocurrency, or how widely it is accepted and used, significantly impacts its profitability. Cryptocurrencies with real-world utility, such as those used in decentralized finance (DeFi) applications, tend to have higher adoption rates and potentially greater profitability.

| Factor | Impact on Profitability |

|---|---|

| Supply and Demand | High demand and limited supply increase profitability |

| Adoption Rate | Higher adoption rates lead to increased profitability |

| Regulatory Environment | Favorable regulations can boost profitability |

Regulatory Environment Impact

The regulatory environment is another crucial factor that influences cryptocurrency profitability. Favorable regulations can provide a boost by increasing investor confidence and adoption, while unfavorable regulations can hinder growth.

Fundamental Analysis for Identifying Profitable Cryptocurrencies

When it comes to identifying profitable cryptocurrencies, fundamental analysis is a crucial step that can make or break your investment decisions. This process involves a thorough examination of a project’s underlying factors to determine its potential for growth and profitability.

Evaluating the Project’s Team and Developers

A project’s team and developers are the driving force behind its success. Experienced and reputable team members can significantly enhance a project’s credibility and potential for profitability. When evaluating a project’s team, look for transparent leadership, a clear vision, and a proven track record in the industry.

Assessing the Technology and Innovation

The technology behind a cryptocurrency is a critical factor in its potential profitability. Innovative solutions that address real-world problems can lead to significant adoption and growth.

Blockchain Architecture Evaluation

A well-designed blockchain architecture is essential for a cryptocurrency’s success. It should be secure, scalable, and capable of handling high transaction volumes.

Scalability and Transaction Speed

Scalability and transaction speed are crucial factors that can make or break a cryptocurrency’s usability and adoption. Look for projects that have implemented solutions to enhance these aspects.

Analyzing the Tokenomics Model

The tokenomics model of a cryptocurrency refers to its economic viability and potential profitability. A well-designed tokenomics model should ensure sustainable token supply, incentivize positive behavior, and align with the project’s overall goals.

Technical Analysis Strategies for Cryptocurrency Trading

Technical analysis is a crucial tool for cryptocurrency traders looking to make informed decisions in a volatile market. By examining past market data, primarily through charts, technical analysis helps traders identify patterns and trends that can inform their trading decisions.

Key Chart Patterns for Crypto Markets

Chart patterns are a fundamental aspect of technical analysis, providing insights into potential market movements. Common patterns include head and shoulders, double tops and bottoms, and triangles. Recognizing these patterns can help traders predict whether a cryptocurrency is likely to continue its current trend or reverse course.

Essential Technical Indicators for Traders

Technical indicators are mathematical calculations based on a cryptocurrency’s price, volume, or open interest. They offer traders additional insights into market dynamics.

Moving Averages and MACD

Moving averages smooth out price data to help identify trends. The Moving Average Convergence Divergence (MACD) indicator, which combines moving averages, signals potential buy and sell opportunities. When the MACD line crosses above the signal line, it’s considered a bullish signal; when it crosses below, it’s bearish.

RSI and Stochastic Oscillators

The Relative Strength Index (RSI) measures the speed and change of price movements, helping traders identify overbought or oversold conditions. Stochastic oscillators compare a cryptocurrency’s closing price to its price range over a specific period, providing insights into potential trend reversals.

Support and Resistance Levels in Crypto Trading

Support and resistance levels are critical components of technical analysis. Support levels represent prices at which a cryptocurrency has historically bounced back, while resistance levels are prices at which it has struggled to break through. Understanding these levels can help traders set strategic entry and exit points.

Risk Management When Trading Cryptocurrencies

To navigate the volatile cryptocurrency market, traders must employ sound risk management techniques. Effective risk management is crucial for minimizing losses and maximizing gains in the highly unpredictable crypto space.

Position Sizing and Portfolio Allocation

Position sizing is a critical aspect of risk management, as it determines the amount of capital allocated to a particular trade. A well-thought-out position sizing strategy helps traders avoid over-exposure to any single asset, thereby reducing overall portfolio risk.

Traders should consider allocating their capital based on their risk tolerance and the volatility of the assets they are trading. A common approach is to allocate a fixed percentage of the total portfolio to each trade, ensuring that no single trade significantly impacts the overall portfolio.

Setting Stop-Loss and Take-Profit Levels

Setting appropriate stop-loss and take-profit levels is essential for managing risk and securing profits. A stop-loss order automatically sells a security when it falls to a certain price, limiting potential losses. Conversely, a take-profit order sells a security when it reaches a predetermined high price, securing gains.

Percentage-Based Stop Losses

Percentage-based stop losses involve setting a stop-loss order at a certain percentage below the purchase price. This strategy allows traders to limit their losses based on the volatility of the asset.

Trailing Stops for Volatile Markets

Trailing stops are a dynamic form of stop-loss orders that adjust as the price of the asset moves. They allow traders to lock in profits while giving the trade room to grow, making them particularly useful in volatile markets.

“The key to successful trading is not to avoid risk, but to manage it effectively.”

Diversification Strategies for Crypto Traders

Diversification is a fundamental risk management strategy that involves spreading investments across different assets to reduce exposure to any single asset’s volatility.

Crypto traders can diversify their portfolios by investing in various cryptocurrencies, such as:

- Established cryptocurrencies like Bitcoin and Ethereum

- Mid-cap altcoins with growth potential

- Emerging cryptocurrencies with innovative technologies

| Diversification Strategy | Description | Risk Level |

|---|---|---|

| Asset Class Diversification | Investing in different types of cryptocurrencies | Medium |

| Industry Diversification | Investing in cryptocurrencies across various industries | Low |

| Geographic Diversification | Investing in cryptocurrencies with different geographic focuses | High |

By implementing these risk management strategies, crypto traders can better navigate the market’s volatility and improve their chances of success.

Most Profitable Cryptocurrencies to Consider in 2025

Identifying profitable cryptocurrencies in 2025 requires a deep understanding of market trends and technological advancements. As the cryptocurrency landscape continues to evolve, investors must stay informed about the most promising digital assets.

Established Blue-Chip Cryptocurrencies

Blue-chip cryptocurrencies have historically demonstrated stability and growth. In 2025, investors are likely to focus on these established players.

Bitcoin and Ethereum Investment Case

Bitcoin and Ethereum remain at the forefront of the cryptocurrency market. Bitcoin’s store of value proposition and Ethereum’s smart contract capabilities make them attractive investments. Their market dominance and widespread adoption contribute to their potential for long-term profitability.

Top 10 Market Cap Coins Analysis

The top 10 cryptocurrencies by market capitalization offer insights into the most valuable and widely recognized digital assets. Coins like Binance Coin and Cardano have shown significant growth and utility within their respective ecosystems.

Promising Mid-Cap Altcoins

Mid-cap altcoins often present a balance between risk and potential return. Cryptocurrencies like Chainlink and Polkadot have gained traction due to their innovative technologies and growing adoption.

Emerging Cryptocurrencies with High Growth Potential

Emerging cryptocurrencies can offer substantial returns, albeit with higher risks. Projects with strong development teams and innovative solutions are likely to attract investor attention in 2025.

By focusing on these categories, investors can identify the most profitable cryptocurrencies in 2025. It’s essential to conduct thorough research and stay updated on market trends to make informed investment decisions.

Evaluating Cryptocurrency Projects for Long-Term Profitability

Long-term profitability in cryptocurrency projects depends on various critical factors that need to be assessed. Evaluating these factors can help investors make informed decisions and avoid potential pitfalls.

Community Strength and Developer Activity

A strong community and active developer base are crucial indicators of a cryptocurrency project’s potential for long-term success. Community engagement can be measured through social media, forums, and other platforms.

GitHub Commits and Development Pace

The frequency and quality of GitHub commits can indicate the project’s development pace and the team’s commitment. A steady stream of updates and improvements is a positive sign.

Community Size and Engagement Metrics

Metrics such as the number of followers, forum posts, and social media interactions can provide insights into the community’s size and engagement level.

Partnerships and Institutional Backing

Partnerships with established companies and backing from reputable institutions can significantly enhance a project’s credibility and potential for long-term profitability.

Roadmap Milestones and Development Progress

A clear roadmap and consistent progress toward achieving milestones are essential for evaluating a project’s potential. Regular updates on progress help maintain investor confidence.

| Evaluation Criteria | Indicators of Success |

|---|---|

| Community Strength | High engagement on social media, active forums |

| Developer Activity | Frequent GitHub commits, regular updates |

| Partnerships | Reputable institutional backing, strategic partnerships |

| Roadmap Progress | Clear milestones, consistent progress |

By carefully evaluating these factors, investors can better assess the long-term profitability potential of cryptocurrency projects.

Market Sentiment Analysis for Cryptocurrency Selection

Market sentiment analysis plays a vital role in identifying profitable cryptocurrency trading opportunities. By understanding the overall attitude of the market towards a particular cryptocurrency, investors can make more informed decisions.

Social Media Indicators and Community Engagement

Social media platforms are a crucial source of market sentiment data. Indicators such as engagement rates, follower growth, and sentiment analysis tools can provide insights into how the community perceives a particular cryptocurrency.

- Monitoring social media discussions and trends

- Analyzing community engagement metrics

- Utilizing sentiment analysis tools

News Impact on Cryptocurrency Prices

News events significantly impact cryptocurrency prices. Understanding the difference between FUD (Fear, Uncertainty, and Doubt) and legitimate concerns is crucial.

Identifying FUD vs. Legitimate Concerns

FUD can lead to market volatility, while legitimate concerns may signal potential issues with a cryptocurrency project.

Evaluating Positive News Catalysts

Positive news, such as partnerships, technological advancements, or adoption by major companies, can drive price increases.

Fear and Greed Index Interpretation

The Fear and Greed Index is a tool used to measure market sentiment. It helps investors understand whether the market is driven by fear or greed.

“The Fear and Greed Index is a useful indicator for investors to gauge market sentiment and make informed decisions.”

By interpreting this index, investors can identify potential buying or selling opportunities.

Investment Strategies for Different Types of Profitable Cryptocurrencies

Different types of cryptocurrencies, such as DeFi tokens and layer-1 blockchains, offer unique investment opportunities. Understanding these opportunities is crucial for maximizing profitability in the cryptocurrency market.

DeFi Token Investment Approaches

Investing in DeFi tokens requires a deep understanding of the DeFi ecosystem. Key factors to consider include the project’s liquidity, security, and the overall demand for its services. It’s also essential to evaluate the token’s use case within the protocol and its potential for growth.

Layer-1 and Layer-2 Blockchain Evaluation

When evaluating layer-1 and layer-2 blockchains, investors should consider several critical factors.

Scalability Solutions Assessment

Layer-1 blockchains like Ethereum are transitioning to more scalable solutions such as Proof of Stake (PoS). Assessing these scalability solutions is vital for understanding the blockchain’s potential for widespread adoption.

Interoperability Features

Layer-2 solutions often focus on improving interoperability between different blockchain networks. Investors should look for projects that enable seamless interactions between various ecosystems, enhancing the overall utility of the blockchain.

NFT and Gaming Token Selection Criteria

For NFT and gaming tokens, the selection criteria include the project’s community engagement, the uniqueness of its digital assets, and its potential for long-term growth. A strong community backing can significantly impact the token’s success.

| Cryptocurrency Type | Key Investment Factors | Potential for Growth |

|---|---|---|

| DeFi Tokens | Liquidity, Security, Demand | High |

| Layer-1 Blockchains | Scalability, Security | High |

| NFT and Gaming Tokens | Community Engagement, Uniqueness | Variable |

By understanding the different investment strategies for various types of cryptocurrencies, investors can make more informed decisions. It’s crucial to stay updated on market trends and the evolving landscape of digital assets.

Tools and Resources for Cryptocurrency Research and Analysis

In the rapidly evolving cryptocurrency market, having the right tools and resources is crucial for making informed investment decisions. The complexity and volatility of the crypto space necessitate a comprehensive approach to research and analysis.

Cryptocurrency Data Platforms and Analytics Tools

Cryptocurrency data platforms and analytics tools are the backbone of any serious crypto research. They provide the necessary data to understand market trends, track asset performance, and make predictions.

On-Chain Analysis Platforms

On-chain analysis platforms offer insights into blockchain data, helping investors understand transaction volumes, wallet activities, and other critical metrics. Platforms like Glassnode and Chainalysis are leading the way in on-chain analysis.

Market Intelligence Services

Market intelligence services aggregate and analyze data from various sources to provide actionable insights. Services such as CoinMarketCap and Messari offer comprehensive data on cryptocurrency prices, market capitalization, and more.

| Platform | Primary Function | Notable Features |

|---|---|---|

| Glassnode | On-Chain Analysis | Detailed blockchain metrics, market indicators |

| Messari | Market Intelligence | Comprehensive crypto data, research reports |

Trading Terminals and Portfolio Trackers

Trading terminals and portfolio trackers are essential tools for active traders and investors. They provide real-time data, advanced charting tools, and the ability to manage portfolios efficiently.

Popular trading terminals include Binance and Kraken, which offer a range of trading pairs and advanced trading features. For portfolio tracking, tools like Blockfolio and Delta provide real-time portfolio valuation and performance analysis.

“The right tools can make all the difference in navigating the complex cryptocurrency market.”

Community Resources and Information Sources

Community resources and information sources play a vital role in staying updated with the latest developments in the cryptocurrency space. Forums like Reddit’s r/CryptoCurrency and Twitter are invaluable for real-time discussions and news.

By leveraging these tools and resources, investors and traders can enhance their research capabilities, make more informed decisions, and stay ahead in the competitive cryptocurrency market.

Common Mistakes to Avoid When Selecting Cryptocurrencies

Making informed decisions in cryptocurrency investment requires avoiding several key mistakes that can impact profitability. Investors must be aware of these common errors to navigate the complex cryptocurrency market effectively.

FOMO-Based Investment Decisions

Fear of Missing Out (FOMO) can lead to impulsive investment decisions, causing investors to buy into cryptocurrencies at peak prices. This emotional response can result in significant losses if the market corrects. To avoid FOMO-based decisions, investors should conduct thorough research and set clear investment goals.

Overlooking Security and Technology Fundamentals

Investors often overlook the security and technological aspects of a cryptocurrency project. Smart contract vulnerabilities and centralization risks are critical factors that can impact a project’s viability.

Smart Contract Vulnerabilities

Smart contracts are self-executing contracts with the terms of the agreement written directly into code. However, vulnerabilities in this code can be exploited by hackers, leading to financial losses.

Centralization Risks

Centralization can make a cryptocurrency more vulnerable to attacks and manipulation. Investors should be cautious of projects with centralized control mechanisms.

Ignoring Market Cycles and Timing

Understanding market cycles and timing is crucial for successful cryptocurrency investment. Ignoring these factors can lead to buying into a cryptocurrency at the wrong time, resulting in losses. Investors should analyze market trends and adjust their strategies accordingly.

Conclusion: Building Your Strategy for Cryptocurrency Trading Success

Successful cryptocurrency trading hinges on a well-informed strategy. By understanding the cryptocurrency market landscape, identifying key factors that influence profitability, and applying fundamental and technical analysis, traders can make informed decisions. Effective risk management and staying abreast of market sentiment are also crucial.

Building a trading strategy that incorporates these elements can significantly enhance the potential for cryptocurrency trading success. It’s essential to evaluate cryptocurrency projects for long-term profitability, consider various investment strategies, and utilize available tools and resources.

Avoiding common mistakes such as FOMO-based investment decisions and overlooking security fundamentals is vital. By adopting a disciplined approach and continually refining your strategy, you can navigate the complexities of the cryptocurrency market and achieve profitable crypto trading.

The key to building a trading strategy that works is ongoing education and adaptation. Stay informed, be patient, and maintain a commitment to your trading goals.

FAQ

What are the key factors to consider when choosing profitable cryptocurrencies for trading?

When selecting cryptocurrencies for trading, consider factors such as market capitalization, trading volume, supply and demand dynamics, adoption rates, and the regulatory environment. Understanding these elements can help identify potentially profitable digital assets.

How do I analyze the profitability of a cryptocurrency?

To analyze the profitability of a cryptocurrency, evaluate its tokenomics model, assess the project’s team and technology, and consider market sentiment. Additionally, examine the cryptocurrency’s historical price movements and potential for future growth.

What is the importance of market capitalization and trading volume in cryptocurrency trading?

Market capitalization and trading volume are crucial indicators of a cryptocurrency’s liquidity and stability. A higher market capitalization and trading volume generally indicate a more stable and liquid market, making it easier to buy and sell the cryptocurrency.

How can I manage risk when trading cryptocurrencies?

To manage risk when trading cryptocurrencies, employ strategies such as position sizing, portfolio allocation, and diversification. Setting stop-loss and take-profit levels can also help mitigate potential losses and maximize gains.

What are some common mistakes to avoid when selecting cryptocurrencies?

Common mistakes to avoid include making FOMO-based investment decisions, overlooking security and technology fundamentals, and ignoring market cycles and timing. It’s essential to conduct thorough research and analysis before investing in a cryptocurrency.

How can I evaluate the long-term profitability of a cryptocurrency project?

To evaluate the long-term profitability of a cryptocurrency project, assess its community strength, developer activity, partnerships, and institutional backing. Examining the project’s roadmap milestones and development progress can also provide insights into its potential for future growth.

What tools and resources are available for cryptocurrency research and analysis?

Various tools and resources are available, including cryptocurrency data platforms, analytics tools, trading terminals, and portfolio trackers. Community resources and information sources, such as social media and online forums, can also aid in making informed investment decisions.

How can I identify emerging cryptocurrencies with high growth potential?

To identify emerging cryptocurrencies with high growth potential, look for projects with innovative technology, a strong development team, and a clear use case. Assessing market sentiment and community engagement can also help identify potential opportunities.

What are the best investment strategies for DeFi tokens and other types of cryptocurrencies?

Investment strategies for DeFi tokens and other cryptocurrencies include evaluating the project’s fundamentals, assessing market sentiment, and considering the overall market environment. Diversification and risk management are also essential for successful cryptocurrency investing.

How can I stay informed about market sentiment and news that may impact cryptocurrency prices?

To stay informed, follow reputable sources of cryptocurrency news, monitor social media indicators, and engage with online communities. Understanding the fear and greed index and other market sentiment indicators can also help make informed investment decisions.