How to Trade in a Bull Market Crypto

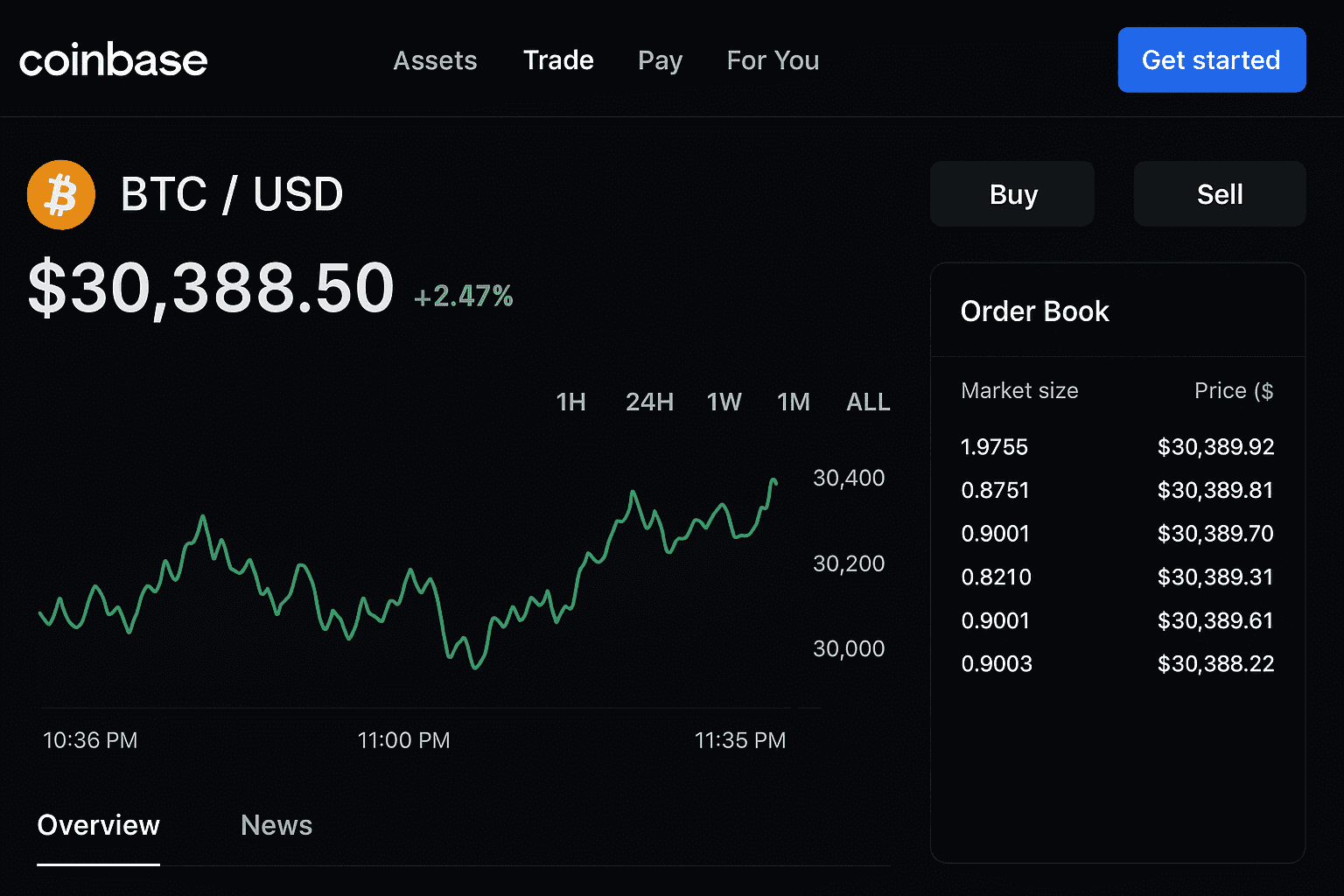

Market Crypto As the cryptocurrency market continues its upward trend, investors are eager to capitalize on the momentum. Trading in a bull market can be both thrilling and intimidating, especially for those new to the world of cryptocurrency.

The key to successful trading lies in understanding the dynamics of a bullish market and employing effective cryptocurrency trading strategies. By doing so, investors can make informed decisions and potentially maximize their gains.

Key Takeaways

- Understand the characteristics of a bull market in cryptocurrency

- Employ effective trading strategies to maximize gains

- Stay informed about market trends and analysis

- Manage risk through diversification and stop-loss orders

- Continuously educate yourself on the latest market developments

Understanding Cryptocurrency Bull Markets

Understanding bull markets in cryptocurrency is crucial for investors looking to capitalize on rising prices. A bull market is a prolonged period of time when the overall price of cryptocurrencies is rising, driven by investor optimism and high demand.

Definition and Characteristics of a Bull Market

A bull market in cryptocurrency is marked by sustained price increases and a positive market sentiment. This environment encourages more investors to buy, further driving up prices.

Key Bull Market Indicators

Several indicators signal the onset of a bull market, including increasing trading volumes and positive news coverage. Technical indicators such as moving averages and relative strength index (RSI) also play a crucial role in identifying bull market trends.

Duration and Intensity Patterns

Bull markets can vary significantly in duration and intensity. Some may last for several months with gradual price increases, while others can be shorter but more intense. Understanding these patterns can help investors make informed decisions.

Historical Crypto Bull Market Cycles

Historical data provides valuable insights into cryptocurrency bull market cycles. By analyzing past trends, investors can better understand the factors that contribute to a bull market.

Analysis of Previous Bull Runs

Previous bull runs have shown that factors such as adoption rates and regulatory news significantly impact market trends. For instance, increased adoption of cryptocurrencies can lead to higher demand and, consequently, higher prices.

Lessons from Past Market Cycles

Past market cycles teach us the importance of risk management and staying informed about market trends. Investors who understand these lessons can better navigate future bull markets.

Identifying a Crypto Bull Market

Identifying a crypto bull market requires a keen understanding of market trends and indicators. Traders must analyze various market signals to determine if the market is entering a bullish phase.

Key Market Indicators

Key market indicators play a crucial role in identifying a crypto bull market. Two primary indicators are price action patterns and volume analysis.

Price Action Patterns

Price action patterns provide insights into market sentiment. Bullish patterns such as the inverse head and shoulders or ascending triangles often signal the beginning of a bull market.

Volume Analysis

Volume analysis is another critical indicator. Increasing volume with rising prices confirms the strength of the trend, indicating a potential bull market.

Technical Analysis Patterns

Technical analysis patterns help traders identify potential bull markets. Chart formations and trend confirmation techniques are essential tools.

Chart Formations Signaling Bull Markets

Certain chart formations, such as bullish engulfing patterns or golden crosses, can signal the onset of a bull market.

Trend Confirmation Techniques

Trend confirmation techniques, including the use of moving averages, help traders verify the direction and strength of the market trend.

On-Chain Metrics to Monitor

On-chain metrics provide valuable insights into market activity. Network activity indicators and whale movement analysis are crucial.

Network Activity Indicators

Network activity indicators, such as transaction counts and active addresses, can signal increased market participation, potentially indicating a bull market.

Whale Movement Analysis

Whale movement analysis involves tracking large transactions. Significant movements by whales can impact market trends and signal potential bull market activity.

| Indicator | Description | Bull Market Signal |

|---|---|---|

| Price Action Patterns | Inverse Head and Shoulders, Ascending Triangles | Bullish Reversal |

| Volume Analysis | Increasing Volume with Rising Prices | Trend Strength |

| Chart Formations | Bullish Engulfing, Golden Cross | Bull Market Onset |

By combining these indicators and analysis techniques, traders can better identify crypto bull markets and make informed trading decisions. Utilizing tools like the Coinglass APP can enhance market analysis and user experience.

Essential Preparation Before Trading

To navigate the complexities of crypto trading during a bull run, thorough preparation is crucial. This involves several key steps that can significantly impact your trading success.

Setting Up Secure Trading Accounts

Choosing a reliable exchange is paramount. Look for exchanges with robust security measures and a good reputation. Security best practices include enabling two-factor authentication and using hardware wallets for storing cryptocurrencies.

Choosing Reliable Exchanges

Research the exchange’s history, user reviews, and security features.

Security Best Practices

Enable two-factor authentication and consider using a hardware wallet.

Creating a Trading Plan

A well-defined trading plan is essential. This includes defining your trading goals and understanding your timeframes.

Defining Goals and Timeframes

Clearly outline your trading objectives and the time you intend to hold your positions.

Position Sizing Strategies

Determine the appropriate position size based on your risk tolerance.

Risk Management Fundamentals

| Risk Management Aspect | Description |

|---|---|

| Determining Risk Tolerance | Assess how much risk you’re willing to take on each trade. |

| Setting Stop-Loss Parameters | Define stop-loss levels to limit potential losses. |

How to Trade in a Bull Market Crypto: Proven Strategies

To maximize profits in a bull market, crypto traders must employ proven strategies that capitalize on the upward trend. Effective trading in a bull market involves a combination of technical analysis, risk management, and market understanding.

Trend Following Techniques

Trend following is a popular strategy in bull markets, where traders ride the upward momentum to maximize gains. Two key techniques used in trend following are:

Moving Average Strategies

Moving averages help traders identify the direction and strength of the trend. By using short and long-term moving averages, traders can spot potential entry and exit points.

Trend Line Trading

Trend lines are used to visualize the trajectory of the market. Trading along these lines can help traders stay aligned with the overall market direction.

Momentum Trading Approaches

Momentum trading involves capitalizing on the strength of the current trend. This can be achieved through:

RSI and MACD Applications

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are indicators used to gauge the momentum of the market. These tools help traders identify overbought or oversold conditions.

Volume-Based Momentum Indicators

Volume indicators confirm the strength of the trend by analyzing trading volume. High volume with price increases can indicate strong buying interest.

Breakout Trading Methods

Breakout trading involves identifying key levels of support or resistance and capitalizing on the breakout. This strategy requires:

Identifying Consolidation Patterns

Consolidation patterns indicate a pause in the market before a potential breakout. Recognizing these patterns can help traders prepare for the next move.

Confirmation Signals for Breakouts

Confirmation signals, such as increased volume or specific candlestick patterns, are crucial for validating breakouts and ensuring that the trade is likely to be successful.

Timing Your Entry Points in Bullish Markets

In the realm of cryptocurrency trading, identifying optimal entry points is crucial during bull markets. A well-timed entry can significantly enhance profitability, while a poorly timed one can lead to substantial losses.

Using Support and Resistance Levels

Support and resistance levels are fundamental tools for determining entry points. These levels indicate where the market has historically shown buying or selling interest.

Horizontal Support/Resistance

Horizontal support and resistance levels are price points where the market has repeatedly reversed direction. Identifying these levels can help traders anticipate potential entry points.

Dynamic Support/Resistance

Dynamic support and resistance levels, such as trend lines, adjust as the price moves. They provide a more nuanced view of market dynamics and can be used to fine-tune entry strategies.

Implementing Moving Averages

Moving averages are another critical tool for timing entry points. They help smooth out price data, making it easier to identify trends.

Golden Cross Strategies

A Golden Cross occurs when a short-term moving average crosses above a long-term moving average, signaling a potential bullish trend reversal.

Multiple Timeframe Analysis

Using multiple timeframes for moving average analysis can provide a more comprehensive view of market trends, helping traders identify robust entry points.

| Timeframe | Moving Average Type | Use in Entry Strategy |

|---|---|---|

| Short-term | 50-day MA | Identifies immediate trend direction |

| Long-term | 200-day MA | Confirms overall trend strength |

Volume Analysis for Entry Confirmation

Volume analysis is crucial for confirming entry points. It provides insights into the strength of price movements.

Volume Precedes Price Principle

The principle that volume precedes price suggests that changes in trading volume can predict price movements, helping traders identify potential entry points.

Volume Profile Trading

Volume profile trading involves analyzing the volume traded at different price levels to identify areas of high buying or selling activity, which can inform entry strategies.

Effective Exit Strategies to Secure Profits

The art of exiting a trade in a bull market can be as important as entering it. As traders ride the wave of a bull market, they must be prepared to secure their profits at the right moment.

Setting Profit Targets

One of the key elements of an effective exit strategy is setting clear profit targets. This involves determining the price level at which you will close your position to lock in gains.

Fibonacci Extension Levels

Traders often use Fibonacci extension levels to predict potential price targets. These levels are based on the Fibonacci sequence and can help identify areas where the price may reverse.

Risk-Reward Based Targets

Another approach is to set targets based on the risk-reward ratio of the trade. This involves determining the potential profit in relation to the potential loss and setting a target that aligns with your trading strategy.

Trailing Stop Loss Techniques

A trailing stop loss is a dynamic stop loss that adjusts as the price moves in your favor. This technique allows traders to lock in profits while giving the trade room to continue moving in the desired direction.

Percentage-Based Trailing Stops

One method is to use a percentage-based trailing stop, where the stop loss is adjusted by a certain percentage as the price moves.

Indicator-Based Trailing Stops

Traders can also use technical indicators, such as moving averages, to set trailing stops. This involves adjusting the stop loss based on the value of the indicator.

Recognizing Potential Market Tops

Identifying potential market tops is crucial for timing exits effectively. This involves analyzing market conditions and using indicators to predict when the market may turn.

Divergence Patterns

Divergence patterns between price and indicators like the RSI or MACD can signal that the market is reaching a top.

Euphoria Phase Indicators

Indicators of euphoria, such as extreme price movements or unusually high trading volumes, can also suggest that the market is nearing a peak.

By combining these strategies, traders can develop a comprehensive approach to exiting trades in a bull market, helping to secure profits and minimize losses.

Altcoin Trading During Bull Markets

Successful altcoin trading in a bull market requires a strategic approach. Altcoin trading strategies need to be adapted to the dynamics of a bull market, where altcoin volatility can be both a risk and an opportunity.

Altcoin Selection Criteria

When selecting altcoins, traders should consider several factors. Fundamental analysis plays a crucial role in identifying promising altcoins.

Fundamental Analysis Factors

- Project roadmap and development team

- Market demand and use case

- Competitive landscape

Liquidity and Market Cap Considerations

Liquidity and market capitalization are also critical. Higher liquidity and a reasonable market cap can indicate a more stable investment.

Managing Altcoin Volatility

Managing altcoin volatility is crucial for minimizing losses and maximizing gains. Position sizing is a key strategy for managing risk.

Position Sizing for High-Risk Assets

Traders should allocate their capital wisely, ensuring that no single trade exposes them to excessive risk.

Correlation-Based Risk Management

Understanding the correlation between different altcoins and Bitcoin can also help in managing risk.

Bitcoin Dominance Considerations

Bitcoin dominance affects altcoin trading. Understanding BTC dominance cycles and altcoin season indicators can provide valuable insights.

BTC Dominance Cycles

Bitcoin’s dominance tends to fluctuate, creating opportunities for altcoin traders during certain cycles.

Altcoin Season Indicators

Identifying altcoin season indicators can help traders time their entries and exits more effectively.

Psychological Aspects of Bull Market Trading

As the market surges, traders must be aware of the psychological factors that can impact their decision-making process. Trading in a bull market can be exhilarating, but it also presents unique psychological challenges that can affect even the most experienced traders.

Managing FOMO and Greed

Fear of Missing Out (FOMO) and greed are two significant psychological hurdles traders face in a bull market. FOMO can lead to impulsive decisions, causing traders to enter positions without proper analysis. To manage FOMO, traders can employ several strategies:

- Stick to a well-defined trading plan.

- Set clear entry and exit points.

- Practice emotional control techniques, such as meditation or deep breathing.

Emotional Control Techniques

Emotional control is crucial for making rational trading decisions. Techniques such as mindfulness and journaling can help traders stay focused and avoid making impulsive decisions based on emotions.

Sticking to Your Trading Plan

A well-defined trading plan serves as a roadmap for traders, helping them stay on track even when the market becomes volatile. Discipline is key to sticking to a trading plan and avoiding deviations based on short-term market fluctuations.

Maintaining Discipline During Euphoria

Bull markets can create a sense of euphoria, leading to overconfidence among traders. To maintain discipline, traders should:

- Continuously assess their trading performance through journaling.

- Avoid confirmation bias by considering multiple sources of information.

- Stay grounded by setting realistic profit targets.

Journaling and Self-Assessment

Journaling is an effective way for traders to reflect on their decisions and identify areas for improvement. Regular self-assessment helps traders stay disciplined and adapt to changing market conditions.

Avoiding Confirmation Bias

Confirmation bias can lead traders to ignore contradictory information and make biased decisions. Seeking diverse perspectives and challenging one’s own assumptions can help mitigate this bias.

Handling Drawdowns and Corrections

Drawdowns and corrections are inevitable in any trading environment. Traders must be mentally prepared for these events and have strategies in place to manage them effectively.

Mental Preparation for Volatility

Mental preparation is crucial for handling market volatility. Traders should anticipate potential drawdowns and have a plan in place to manage their emotions during these periods.

Recovery Strategies After Losses

After experiencing losses, traders should focus on recovery strategies, such as reassessing their trading plan and adjusting their risk management techniques. Resilience is key to bouncing back from losses and continuing to trade effectively.

Leveraging Tools and Indicators for Bull Market Trading

Leveraging the appropriate tools and indicators is crucial for navigating the complexities of crypto bull markets. Traders can significantly enhance their decision-making process by utilizing a combination of technical indicators, advanced trading platforms, and market sentiment analysis.

Essential Technical Indicators

Technical indicators play a vital role in identifying potential trading opportunities. Two key categories of indicators are particularly useful:

Oscillators for Overbought Conditions

Oscillators such as the Relative Strength Index (RSI) help traders identify overbought conditions, signaling potential market reversals.

Trend-Following Indicators

Trend-following indicators like Moving Averages (MA) enable traders to ride the momentum of the market, maximizing profits during strong trends.

Trading Platforms and Tools

The choice of trading platform and tools can significantly impact trading performance. Key considerations include:

Charting Software Comparison

Advanced charting software provides traders with the ability to analyze market trends and patterns. Popular options include TradingView and Coinigy.

Portfolio Tracking Applications

Portfolio tracking applications like the Coinglass APP offer a comprehensive user experience, enabling traders to monitor their investments in real-time.

Market Sentiment Analysis

Understanding market sentiment is crucial for making informed trading decisions. Useful tools for sentiment analysis include:

Social Media Sentiment Indicators

Social media sentiment indicators help gauge market mood by analyzing posts and discussions on platforms like Twitter.

Fear and Greed Index Applications

The Fear and Greed Index provides a quantitative measure of market sentiment, helping traders identify potential buying or selling opportunities.

| Indicator/Tool | Description | Use Case |

|---|---|---|

| RSI | Relative Strength Index | Identifying overbought conditions |

| MA | Moving Averages | Following market trends |

| Coinglass APP | Portfolio Tracking | Monitoring investments |

| Fear and Greed Index | Market Sentiment Analysis | Identifying buying/selling opportunities |

Common Bull Market Trading Mistakes to Avoid

Trading in a bull market can be exhilarating, but it’s crucial to avoid common pitfalls that can lead to significant losses. Traders must be aware of the mistakes that can derail their success.

FOMO and Emotional Trading

Fear of Missing Out (FOMO) can lead to impulsive decisions, often resulting in buying at peaks and selling at troughs. Recognizing emotional triggers is the first step to mitigating this risk.

Recognizing Emotional Triggers

- Monitoring market news and social media for hype

- Awareness of personal risk tolerance

Implementing Trading Rules

Having a set of predefined trading rules can help in sticking to a strategy, thus reducing the impact of emotional decisions.

Overtrading and Overleveraging

Overtrading and overleveraging are common mistakes that can amplify losses. Understanding the appropriate use of leverage is crucial.

Appropriate Leverage Guidelines

- Assessing the maximum leverage available

- Understanding the risks associated with high leverage

Trading Frequency Optimization

Optimizing trading frequency can help in managing risk and avoiding the pitfalls of overtrading.

Ignoring Risk Management

Effective risk management is the backbone of successful trading. Ignoring it can lead to significant drawdowns.

Portfolio Exposure Limits

- Setting limits on portfolio exposure to volatile assets

- Diversifying investments to mitigate risk

Correlation Risk Assessment

Understanding how different assets correlate can help in managing overall portfolio risk.

By being aware of these common bull market trading mistakes, traders can better navigate the complexities of the crypto market and improve their chances of success.

Tax Considerations for Crypto Bull Market Trading

Crypto bull market trading is not just about making profits; it’s also about navigating complex tax obligations. As traders capitalize on the upward trend, they must also be aware of the tax implications of their trades.

Understanding Crypto Tax Obligations

Crypto trading profits are subject to capital gains tax. It’s essential to understand how these gains are classified.

Capital Gains Implications

Capital gains from crypto trading are taxable and must be reported. The tax rate depends on whether the gain is considered long-term or short-term.

Trading vs. Investing Classifications

The IRS distinguishes between traders and investors, with different tax implications for each. Traders may be eligible for more favorable tax treatment.

Record-Keeping Best Practices

Accurate record-keeping is crucial for crypto traders to ensure compliance with tax regulations.

Transaction Documentation Requirements

Traders must document all transactions, including dates, amounts, and the value of the cryptocurrency at the time of the trade.

Tax Software Solutions

Utilizing tax software can simplify the process of tracking trades and calculating tax liabilities.

Tax-Efficient Trading Strategies

Traders can employ strategies to minimize their tax burden.

Tax-Loss Harvesting Techniques

Offsetting gains with losses can reduce tax liabilities. This involves selling securities that have declined in value.

Long-Term vs. Short-Term Holding Strategies

Holding assets long-term can result in more favorable tax rates compared to short-term holdings.

Conclusion

Navigating a bull market in cryptocurrency requires a well-thought-out strategy, discipline, and a thorough understanding of market dynamics. This article has provided a comprehensive guide on how to trade in a bull market crypto, covering essential topics from understanding bull markets to leveraging tools and indicators for informed trading decisions.

A summary of crypto trading in a bull market highlights the importance of identifying key market indicators, using technical analysis patterns, and monitoring on-chain metrics. By combining these approaches, traders can make informed decisions and capitalize on the upward trend.

For traders looking to succeed in a bull market, final tips include maintaining a trading plan, managing risk effectively, and staying informed about market developments. It’s also crucial to avoid common mistakes such as FOMO-driven trading, overtrading, and ignoring risk management principles.

By following the strategies and tips outlined in this article, traders can enhance their trading performance and navigate the complexities of a bull market with confidence. Staying disciplined and adaptable is key to achieving success in the ever-changing cryptocurrency landscape.

FAQ

What is a bull market in cryptocurrency?

A bull market in cryptocurrency refers to a prolonged period where prices are rising, and investor sentiment is positive, often driven by increased demand and adoption.

How do I identify a crypto bull market?

To identify a crypto bull market, look for key indicators such as rising prices, increasing trading volume, and positive market sentiment, as well as technical analysis patterns and on-chain metrics.

What are the best strategies for trading in a bull market crypto?

Proven strategies for trading in a bull market crypto include trend following techniques, momentum trading approaches, and breakout trading methods, as well as setting profit targets and using trailing stop loss techniques.

How do I manage risk when trading in a bull market?

To manage risk when trading in a bull market, it’s essential to set clear trading goals, determine risk tolerance, and implement risk management techniques such as position sizing and stop-loss orders.

What are the tax implications of trading in a bull market crypto?

Trading in a bull market crypto has tax implications, including capital gains tax on profits, and it’s essential to keep accurate records and consider tax-efficient trading strategies.

How do I avoid common mistakes when trading in a bull market?

To avoid common mistakes when trading in a bull market, be aware of FOMO and emotional trading, avoid overtrading and overleveraging, and prioritize risk management.

What tools and indicators are useful for bull market trading?

Useful tools and indicators for bull market trading include technical indicators such as RSI and MACD, trading platforms with advanced charting software, and market sentiment analysis.

How do I maintain discipline during a bull market?

To maintain discipline during a bull market, stick to your trading plan, avoid impulsive decisions based on emotions, and prioritize risk management and emotional control techniques.

What are the key factors to consider when trading altcoins in a bull market?

When trading altcoins in a bull market, consider factors such as altcoin selection criteria, managing volatility, and understanding Bitcoin dominance, as well as fundamental analysis and position sizing.