Bitcoin Cash Trading: Unlock Your Earning Potential

Bitcoin Cash Trading: Unlock Your Earning Potential

Bitcoin Cash Trading: Unlock Your Earning Potential

Can a cryptocurrency with a strong technical foundation and high market cap offer lucrative trading opportunities? The answer lies in understanding the dynamics of Bitcoin Cash trading and its potential in the digital currency exchange market.

As one of the top 30 biggest cryptocurrencies in the world, Bitcoin Cash presents a compelling case for traders. With its solid technical foundation and significant market presence, BCH market analysis becomes crucial for identifying growth opportunities.

Key Takeaways

- Understanding the potential of Bitcoin Cash in the cryptocurrency market.

- Importance of BCH market analysis for traders.

- Opportunities for growth in digital currency exchange.

- Role of technical foundation in cryptocurrency trading.

- Significance of market cap in determining trading potential.

Understanding Bitcoin Cash (BCH)

As a fork of the Bitcoin blockchain, Bitcoin Cash (BCH) has carved out its own niche in the cryptocurrency market. Bitcoin Cash was created to address some of the scalability issues faced by Bitcoin, particularly in terms of transaction speed and cost.

The Origin and Evolution of Bitcoin Cash

Bitcoin Cash emerged in August 2017 as a result of a hard fork from the Bitcoin blockchain. This fork was driven by disagreements within the Bitcoin community regarding the best way to scale the network. The primary goal of Bitcoin Cash was to enable faster and cheaper transactions, making it more suitable for everyday use as a digital currency.

How Bitcoin Cash Differs from Bitcoin (BTC)

The main difference between Bitcoin Cash and Bitcoin lies in their approach to scalability. Bitcoin Cash increased the block size limit to 32 MB, allowing for more transactions to be processed per block compared to Bitcoin’s 1 MB limit. This change enables Bitcoin Cash to handle a higher volume of transactions, potentially reducing congestion and fees.

Key Features and Benefits of BCH

Bitcoin Cash offers several key benefits, including improved transaction speeds and lower fees compared to Bitcoin. Its larger block size allows for more transactions per block, making it more scalable. Additionally, Bitcoin Cash has maintained a strong development community, ensuring continued innovation and support.

In summary, Bitcoin Cash represents a significant evolution in cryptocurrency, offering a viable alternative to Bitcoin with its enhanced scalability features. As the cryptocurrency landscape continues to evolve, understanding the nuances of Bitcoin Cash and its differences from Bitcoin is crucial for investors and users alike.

Getting Started with Bitcoin Cash Trading

Embarking on your Bitcoin Cash trading journey requires a solid foundation, starting with the right tools and knowledge. To begin trading Bitcoin Cash (BCH), you’ll need to set up a few essential components.

Setting Up a Bitcoin Cash Wallet

The first step in Bitcoin Cash trading is setting up a Bitcoin Cash wallet. There are various types of wallets available, including hardware and software wallets, each with its own security features. When choosing a wallet, consider factors such as ease of use, security, and compatibility with your device.

- Hardware wallets offer enhanced security by storing your private keys offline.

- Software wallets provide convenience and are accessible from your computer or mobile device.

Choosing the Right BCH Trading Platform

Selecting a reliable BCH trading platform is crucial for successful trading. Look for platforms that offer competitive fees, robust security measures, and a user-friendly interface. Some popular options include:

- Centralized exchanges that offer a wide range of trading pairs.

- Decentralized exchanges that provide greater autonomy and security.

Security Considerations for BCH Traders

Security is paramount in cryptocurrency trading. To protect your assets, consider implementing the following security measures:

- Enable two-factor authentication (2FA) on your trading platform and wallet.

- Use strong, unique passwords for all accounts.

- Regularly update your software and firmware to ensure you have the latest security patches.

By following these steps and considering the security of your trading activities, you can confidently start your Bitcoin Cash trading journey.

The Fundamentals of Bitcoin Cash Trading

Bitcoin Cash trading requires a solid grasp of market dynamics, trading terminology, and strategic analysis. To succeed in this space, traders must understand the underlying principles that drive the Bitcoin Cash (BCH) market.

Understanding BCH Market Dynamics

The BCH market is influenced by various factors, including supply and demand, market sentiment, and global economic trends. Understanding these dynamics is crucial for making informed trading decisions. Market analysis involves examining historical data, current trends, and potential future developments to predict price movements.

Reading BCH Price Charts

Price charts are essential tools for traders, providing visual representations of market data. To read BCH price charts effectively, traders need to understand chart types, including line charts, candlestick charts, and bar charts. Each type offers unique insights into market behavior.

Key Trading Terminology for BCH Investors

Familiarity with trading terminology is vital for navigating the BCH market. Key terms include:

- Long position: Buying BCH with the expectation of selling it at a higher price.

- Short position: Selling BCH with the expectation of buying it back at a lower price.

- Liquidity: The ease with which BCH can be bought or sold without affecting its price.

Order Types Explained

Understanding different order types is crucial for executing trades effectively. Common order types include:

| Order Type | Description |

|---|---|

| Market Order | Executed immediately at the best available price. |

| Limit Order | Executed at a specified price or better. |

| Stop-Loss Order | Executed when the price reaches a specified level, limiting potential losses. |

Understanding Trading Pairs with BCH

Trading pairs involve exchanging one cryptocurrency for another. In the context of BCH, common trading pairs include BCH/USD, BCH/BTC, and BCH/ETH. Understanding these pairs is essential for diversifying trading strategies.

By mastering these fundamentals, traders can develop a robust understanding of the BCH market, enabling them to make more informed decisions and navigate the complexities of cryptocurrency trading.

Effective Bitcoin Cash Trading Strategies

To succeed in Bitcoin Cash trading, it’s crucial to adopt effective strategies that align with your investment goals and risk tolerance. The cryptocurrency market is known for its volatility, and having a well-thought-out approach can make a significant difference in your trading outcomes.

Day Trading with Bitcoin Cash

Day trading involves making multiple trades within a single day, taking advantage of the market’s fluctuations. This strategy requires constant monitoring of the market and quick decision-making. Day traders must be disciplined and have a solid understanding of technical analysis to identify profitable trades.

Swing Trading Techniques for BCH

Swing trading is a strategy that involves holding positions for a shorter period than investing, but longer than day trading. It requires identifying market trends and using technical indicators to determine entry and exit points. Swing traders can benefit from the market’s volatility without the need for constant monitoring.

Long-term Investment Approaches

For those who prefer a more hands-off approach, long-term investing in Bitcoin Cash can be a viable strategy. This involves holding BCH for an extended period, riding out market fluctuations. Long-term investors must have a strong conviction in the potential of Bitcoin Cash and be willing to weather market volatility.

Risk Management in BCH Trading

Regardless of the trading strategy, risk management is crucial. This includes setting stop-loss orders, limiting position sizes, and diversifying investments. Effective risk management helps protect against significant losses and ensures that trading remains sustainable.

Technical Analysis for BCH Market Success

In the volatile world of cryptocurrency, technical analysis provides BCH traders with a strategic edge. Technical analysis involves examining past market data, primarily price and volume, to forecast future price movements.

Essential Technical Indicators for BCH

Technical indicators are crucial tools for BCH traders. Some of the most commonly used indicators include:

- Moving Averages: Help identify trends and provide support and resistance levels.

- Relative Strength Index (RSI): Measures the magnitude of recent price changes to determine overbought or oversold conditions.

- Bollinger Bands: Use a moving average and standard deviations to gauge volatility and identify potential breakouts.

Chart Patterns in BCH Markets

Chart patterns are graphical representations of price movements that can help predict future market trends. Common chart patterns include:

- Head and Shoulders: Indicates a potential reversal in the market trend.

- Double Tops and Bottoms: Signal potential trend reversals.

- Triangles: Indicate a consolidation phase before a potential breakout.

Using Technical Analysis Tools Effectively

To maximize the effectiveness of technical analysis, traders should combine multiple indicators and chart patterns. It’s also essential to stay updated with market news and adjust strategies accordingly.

Popular Software for BCH Technical Analysis

Several software tools are available for technical analysis of BCH markets, including:

- TradingView: Offers a wide range of technical indicators and charting tools.

- Coinigy: Provides advanced charting and trading capabilities.

- CryptoSpectator: Specializes in cryptocurrency market analysis.

Fundamental Analysis in Bitcoin Cash Markets

To make informed trading decisions, investors must delve into fundamental analysis, examining the underlying factors that influence Bitcoin Cash’s price. Fundamental analysis involves a comprehensive evaluation of the factors that could impact the value of BCH, providing traders with a deeper understanding of the market.

Evaluating BCH Network Health

One crucial aspect of fundamental analysis is assessing the health of the Bitcoin Cash network. This includes examining metrics such as hash rate, block size, and transaction volume. A robust and active network is often a good indicator of a cryptocurrency’s potential for growth.

Monitoring Development and Adoption

Another key factor is monitoring the development and adoption of Bitcoin Cash. This involves staying updated on protocol upgrades, new feature implementations, and the overall adoption rate among users and businesses. Increased adoption and continuous development are positive indicators for the cryptocurrency’s value.

Assessing Market Sentiment for BCH

Assessing market sentiment is also vital in fundamental analysis. This involves analyzing news, social media, and community forums to gauge the overall attitude towards Bitcoin Cash. Positive sentiment can drive the price up, while negative sentiment can lead to a decrease.

News Sources and Community Insights

Staying informed through reliable news sources and community insights is essential for assessing market sentiment. Traders should follow reputable cryptocurrency news outlets and engage with community forums to get a well-rounded view of the market sentiment towards BCH.

By combining these elements of fundamental analysis, traders can gain a comprehensive understanding of Bitcoin Cash’s potential, making more informed decisions in the process.

Advanced Bitcoin Cash Trading Techniques

As traders become more experienced in the Bitcoin Cash (BCH) market, they often seek advanced trading techniques to maximize their profits. These techniques can provide greater flexibility and potential for returns, but they also come with increased risk.

Leverage Trading with BCH

Leverage trading allows traders to borrow funds to increase their trading position, potentially amplifying their gains. However, it also magnifies losses. It’s crucial for traders to understand the risks and use leverage judiciously. Many exchanges offer leverage trading options for BCH, with varying levels of leverage available.

Options and Futures for Bitcoin Cash

Options and futures contracts are sophisticated financial instruments that allow traders to speculate on the future price of BCH. These derivatives can be used for hedging or speculative purposes. Options give traders the right, but not the obligation, to buy or sell BCH at a predetermined price, while futures contracts obligate the buyer to purchase BCH at a set price on a specific date.

Arbitrage Opportunities in BCH Markets

Arbitrage involves exploiting price differences between exchanges or markets. Traders can buy BCH on one exchange where the price is lower and sell it on another where the price is higher. This strategy requires quick execution and an understanding of market dynamics.

Automated Trading Systems for BCH

Automated trading systems use algorithms to execute trades based on predefined criteria. These systems can help traders capitalize on opportunities 24/7 without constant manual intervention. They can be particularly useful for executing complex strategies or for traders who lack the time to monitor markets constantly.

| Trading Technique | Description | Risk Level |

|---|---|---|

| Leverage Trading | Borrowing funds to increase trading position | High |

| Options and Futures | Derivatives for speculation or hedging | High |

| Arbitrage | Exploiting price differences between exchanges | Medium |

| Automated Trading Systems | Algorithm-based trading without manual intervention | Variable |

Top Platforms and Tools for Bitcoin Cash Trading

When it comes to Bitcoin Cash trading, having the right platforms and tools is crucial for success. The landscape of BCH trading is supported by a variety of options, each with its unique features and benefits.

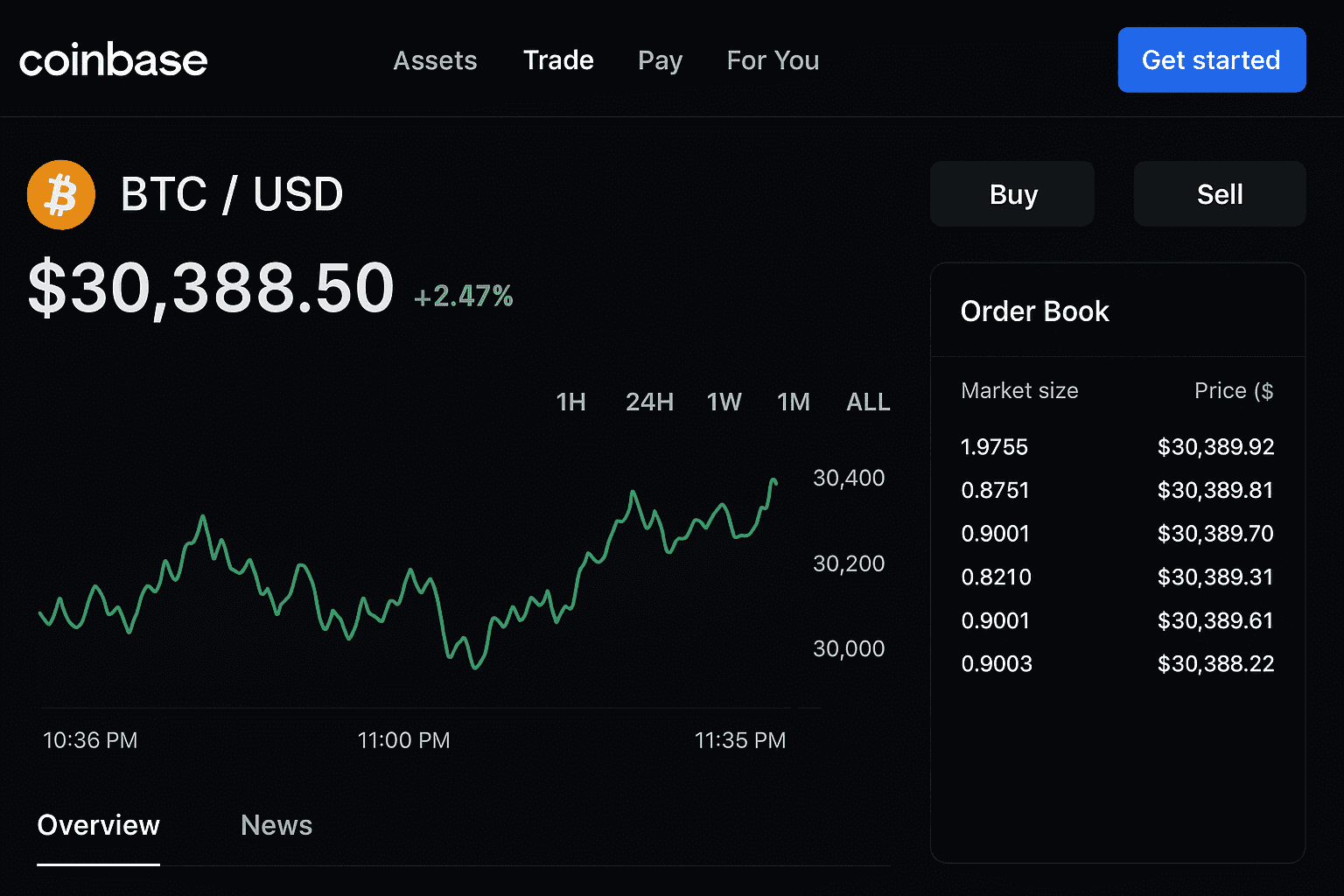

Centralized Exchanges for BCH Trading

Centralized exchanges remain a popular choice for BCH traders due to their ease of use and high liquidity. Some of the top centralized exchanges for BCH include:

- Binance

- Coinbase

- Kraken

These exchanges offer a range of trading pairs and advanced trading features.

Decentralized Exchange Options

For those looking for an alternative to centralized exchanges, decentralized exchanges (DEX) offer a more secure and private way to trade BCH. Popular DEX options include:

- Uniswap

- PancakeSwap

DEX platforms allow for trustless transactions and greater control over your assets.

Mobile Trading Applications for BCH

Mobile trading apps provide the flexibility to trade BCH on the go. Some notable mobile trading applications include:

- BlockFi

- Coinbase Mobile

These apps often feature user-friendly interfaces and push notifications for market updates.

Portfolio Tracking and Analysis Tools

To effectively manage your BCH investments, portfolio tracking and analysis tools are essential. Platforms like:

- Blockfolio

- Delta

offer real-time tracking and in-depth analysis of your cryptocurrency holdings.

By leveraging these top platforms and tools, BCH traders can enhance their trading experience and make more informed decisions.

Managing Risks and Regulatory Considerations

Effective risk management is crucial for success in Bitcoin Cash trading. As with any investment, there are risks involved, and understanding how to mitigate them is key to maximizing profits.

Setting Stop-Loss and Take-Profit Orders

One of the fundamental risk management strategies in Bitcoin Cash trading is setting stop-loss and take-profit orders. A stop-loss order automatically sells your BCH when it falls to a certain price, limiting potential losses. Conversely, a take-profit order sells your BCH when it reaches a predetermined price, securing your gains.

For example, if you buy BCH at $500, you might set a stop-loss at $450 and a take-profit at $550. This way, you’re limiting your potential loss to 10% while securing a 10% gain.

Portfolio Diversification Strategies

Diversifying your investment portfolio is another critical risk management technique. By spreading your investments across different assets, you reduce the risk associated with any single investment.

A diversified portfolio might include a mix of cryptocurrencies, stocks, and bonds. For instance, you could allocate 50% of your portfolio to Bitcoin Cash, 30% to other cryptocurrencies, and 20% to traditional assets like stocks or bonds.

Understanding Tax Obligations for BCH Trading

Understanding your tax obligations is essential for compliance and effective financial planning. In the United States, the IRS treats cryptocurrencies as property for tax purposes.

This means that gains or losses from Bitcoin Cash trading are subject to capital gains tax. It’s crucial to keep accurate records of your trades to report them correctly on your tax return.

Navigating Regulatory Frameworks in the US

The regulatory environment for cryptocurrencies in the US is evolving. It’s essential to stay informed about the latest developments to ensure compliance.

For example, the SEC has guidelines on digital assets, and understanding these can help you navigate the regulatory landscape. Compliance is key to avoiding legal issues and ensuring the longevity of your trading activities.

| Regulatory Body | Role in BCH Regulation |

|---|---|

| SEC | Oversees digital asset regulations, including BCH |

| CFTC | Regulates commodity trading, which may include BCH |

| IRS | Handles tax implications of BCH trading |

“The key to successful trading is not just about making profits, but also about managing risks effectively.”

Conclusion: Maximizing Your Bitcoin Cash Trading Potential

By understanding the intricacies of Bitcoin Cash and applying effective trading strategies, traders can unlock their full potential in the BCH market. The key to successful bitcoin cash trading lies in education, strategy, and risk management.

Traders who master technical and fundamental analysis, stay updated on market dynamics, and utilize the right tools can maximize their cryptocurrency trading profits. Whether you’re a seasoned trader or just starting out, the strategies outlined in this article provide a comprehensive foundation for achieving success.

To continue maximizing your potential, it’s essential to stay informed about market trends, regulatory changes, and the evolving landscape of cryptocurrency trading. By doing so, you’ll be well-equipped to navigate the markets and make informed decisions, ultimately enhancing your trading performance and achieving your financial goals.

FAQ

What is Bitcoin Cash (BCH) and how does it differ from Bitcoin (BTC)?

Bitcoin Cash is a cryptocurrency that emerged as a result of a hard fork from the Bitcoin blockchain. It differs from Bitcoin in its larger block size, allowing for faster transaction processing and lower fees.

How do I get started with Bitcoin Cash trading?

To start trading Bitcoin Cash, you need to set up a BCH wallet, choose a reputable trading platform, and understand the security considerations to protect your assets.

What are the key features and benefits of using Bitcoin Cash?

Bitcoin Cash offers faster transaction times, lower fees, and a larger block size compared to Bitcoin. Its benefits include improved scalability and usability for everyday transactions.

What is the best way to manage risk when trading Bitcoin Cash?

Effective risk management in BCH trading involves setting stop-loss and take-profit orders, diversifying your portfolio, and staying informed about market trends and analysis.

How can I stay up-to-date with the latest developments and news in the Bitcoin Cash ecosystem?

You can stay informed through official Bitcoin Cash news sources, community forums, and social media channels, as well as by following reputable cryptocurrency news outlets.

What are the tax implications of trading Bitcoin Cash in the US?

Trading Bitcoin Cash is subject to capital gains tax in the US. It’s essential to understand your tax obligations and consult with a tax professional to ensure compliance with IRS regulations.

Can I use leverage when trading Bitcoin Cash, and what are the risks?

Yes, some platforms offer leverage trading for Bitcoin Cash. However, leverage trading amplifies both potential gains and losses, so it’s crucial to use it cautiously and within your risk tolerance.

What are the differences between centralized and decentralized exchanges for BCH trading?

Centralized exchanges are traditional platforms that facilitate trading, while decentralized exchanges operate on blockchain technology, allowing for peer-to-peer transactions without intermediaries.

How can I use technical analysis to improve my Bitcoin Cash trading decisions?

Technical analysis involves studying price charts and using indicators to predict future price movements. It can help you identify trends, set entry and exit points, and refine your trading strategy.

What are some advanced trading techniques for experienced Bitcoin Cash traders?

Advanced techniques include arbitrage, automated trading systems, and options and futures trading. These strategies can offer additional opportunities for profit but also come with increased complexity and risk.

How can I protect my Bitcoin Cash holdings from security threats?

To secure your BCH holdings, use a reputable wallet, enable two-factor authentication, keep your software up to date, and be cautious of phishing attempts and other scams.

What is the role of fundamental analysis in Bitcoin Cash trading?

Fundamental analysis involves evaluating the underlying factors that affect the value of Bitcoin Cash, such as network health, adoption rates, and market sentiment. It helps traders make informed decisions based on the asset’s intrinsic value.