Best Exchanges for Cryptocurrency Trading in 2026

Best Exchanges for Cryptocurrency Trading in 2026

Best Exchanges for Cryptocurrency Trading in 2026

Trading exchanges. Are you ready to dive into the world of cryptocurrency, but unsure which platform to trust? With the rapid evolution of digital assets, choosing the right cryptocurrency exchange has become a crucial decision for investors.

In 2026, the landscape of online trading platforms is expected to be more competitive than ever, with emerging trends in cryptocurrencies like XRP, Stellar, and Algorand. As the demand for a reliable digital assets marketplace grows, so does the importance of selecting a platform that meets your forex trading needs.

The key to successful cryptocurrency investment lies in understanding the nuances of different trading exchanges. As we explore the best options available in 2026, it’s essential to consider factors that make a platform stand out.

Key Takeaways

- Top cryptocurrency exchanges in 2026 will offer enhanced security features.

- Competitive fees and robust customer support will be key differentiators.

- Emerging cryptocurrencies like XRP, Stellar, and Algorand will gain more traction.

- User-friendly interfaces will become increasingly important.

- Regulatory compliance will be a major focus for exchanges.

The Future of Cryptocurrency Markets in 2026

As we approach 2026, the cryptocurrency market is poised for significant transformations driven by regulatory changes and technological advancements. The industry is expected to witness a paradigm shift as regulatory bodies worldwide continue to refine their approaches to cryptocurrency regulation.

Regulatory Landscape and Compliance

The regulatory landscape for cryptocurrencies is evolving rapidly. Recent regulatory wins, such as the clarity provided for XRP, signal a move towards more defined regulatory frameworks. In 2026, we can expect:

- Stricter compliance requirements for cryptocurrency exchanges

- Enhanced anti-money laundering (AML) and know-your-customer (KYC) protocols

- Increased collaboration between regulatory bodies and industry stakeholders

These developments will likely lead to a more secure and transparent cryptocurrency market, fostering greater trust among investors and users.

Technological Advancements in Trading Infrastructure

Technological advancements are set to revolutionize the cryptocurrency trading infrastructure in 2026. Emerging technologies such as blockchain innovations and layer-2 scaling solutions will enhance the efficiency and scalability of cryptocurrency exchanges. Key advancements include:

- Improved transaction processing times

- Enhanced security measures through advanced cryptography

- Better user interfaces and experience

These technological improvements will make cryptocurrency trading more accessible and user-friendly, potentially leading to increased adoption and market growth.

Key Criteria for Evaluating Trading Exchanges

To navigate the complex landscape of cryptocurrency trading, it’s essential to understand the key factors that distinguish reliable exchanges. When evaluating trading exchanges, several critical criteria come into play, ensuring that traders can make informed decisions.

Security Protocols and Insurance Policies

A robust security framework is paramount for any trading exchange. This includes multi-factor authentication, cold storage solutions, and regular security audits. Insurance policies that cover potential losses due to hacking or other security breaches also provide an additional layer of protection for traders.

Fee Structures and Trading Costs

Understanding the fee structure of a trading exchange is crucial, as it directly impacts trading costs. Exchanges may charge maker and taker fees, withdrawal fees, and other costs. Transparent and competitive fee structures are indicative of a well-designed exchange.

User Experience and Platform Accessibility

The user experience is a significant factor in choosing a trading exchange. A platform that is intuitive, responsive, and accessible across various devices enhances the trading experience. Features such as real-time data feeds, advanced charting tools, and customer support are also essential for a seamless trading experience.

By carefully evaluating these key criteria, traders can select an exchange that meets their specific needs, ensuring a secure, cost-effective, and user-friendly trading environment.

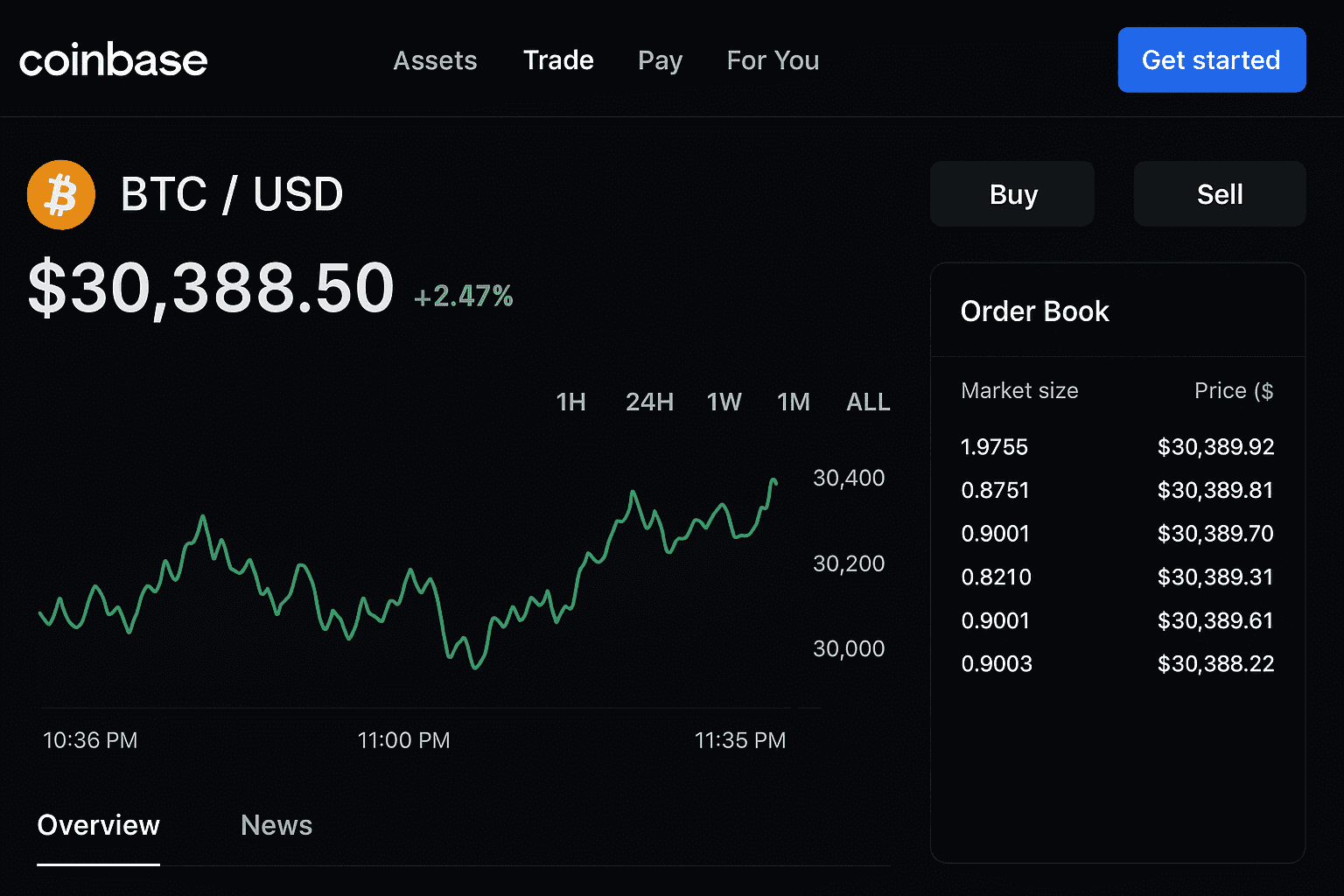

Coinbase Prime: Enterprise-Grade Trading Platform

As the cryptocurrency market continues to evolve, Coinbase Prime stands out as a premier trading platform for institutional investors. With its robust infrastructure and comprehensive suite of services, Coinbase Prime is designed to meet the complex needs of professional traders and large-scale investors.

Coinbase Prime in 2026

Overview

Coinbase Prime is an institutional-grade trading platform that offers advanced trading tools, secure custody solutions, and dedicated client support. It is designed for professional traders and institutional investors who require a high level of service and reliability.

Pros

- Advanced trading tools and analytics

- Secure custody solutions with robust security protocols

- Dedicated client support for high-net-worth individuals and institutions

Cons

- May have higher fees compared to other exchanges

- Primarily designed for institutional investors, which may limit accessibility for individual traders

Features

Coinbase Prime offers a range of features, including:

- Advanced trading APIs for automated trading strategies

- Multi-signature wallets for enhanced security

- Real-time market data and analytics

| Feature | Description | Benefit |

|---|---|---|

| Advanced Trading APIs | Enables automated trading strategies | Increased trading efficiency |

| Multi-Signature Wallets | Provides enhanced security for digital assets | Reduced risk of asset loss |

| Real-Time Market Data | Offers up-to-the-minute market insights | Informed trading decisions |

Who Should Use Coinbase Prime

Coinbase Prime is ideal for institutional investors and professional traders who require a high level of service, advanced trading tools, and robust security measures. It is particularly suited for those who need dedicated client support and are willing to pay a premium for high-quality services.

Binance US: Most Comprehensive Trading Exchange

As the cryptocurrency market evolves, Binance US stands out for its comprehensive trading features. Binance US has been gaining traction due to its robust infrastructure and wide range of services offered to traders in the United States.

Evolution and Current State

Binance US has made significant strides in the cryptocurrency trading space. Its commitment to providing a secure and reliable trading environment has attracted a large user base.

Binance US in 2026

Overview

By 2026, Binance US is expected to further enhance its trading capabilities. The platform’s focus on innovation will likely introduce new features that cater to the evolving needs of traders.

Pros

- High liquidity

- Advanced trading tools

- Robust security measures

Cons

- Complex interface for beginners

- Regulatory challenges

Features

Binance US offers a variety of trading pairs and advanced order types. The platform’s user interface is designed to be intuitive, making it easier for traders to navigate and execute trades.

Target Audience

Binance US is suitable for both novice and experienced traders. Its comprehensive features and high liquidity make it an attractive option for those looking for a reliable trading platform.

Kraken: Best for Security-Focused Traders

In the rapidly changing landscape of cryptocurrency trading, Kraken remains a top choice for security-conscious traders. Kraken’s strong security features make it an ideal platform for those who prioritize asset protection.

Advanced Security Measures

Overview

Kraken has consistently demonstrated its commitment to security through various measures, including multi-factor authentication and cold storage solutions. These features ensure that users’ assets are well-protected against potential threats.

Pros

- Robust Security Protocols: Kraken employs advanced security measures to safeguard user accounts and assets.

- Regulatory Compliance: Kraken adheres to relevant financial regulations, providing an additional layer of security and trust.

- Transparent Operations: Kraken maintains transparency in its operations, helping users understand how their assets are managed.

Cons

- Limited Cryptocurrency Options: Compared to some other exchanges, Kraken offers a relatively limited selection of cryptocurrencies.

- Complex Interface: The platform’s interface can be complex and may require a learning curve for new users.

Features

Kraken offers a range of features that cater to security-focused traders, including:

- Advanced Trading Tools: Kraken provides sophisticated trading tools that help users make informed decisions.

- Real-time Market Data: Users have access to real-time market data, enabling them to react quickly to market changes.

Who Should Use Kraken

Kraken is particularly suited for experienced traders who prioritize security and are looking for a reliable platform to manage their digital assets. Its advanced features and robust security measures make it an excellent choice for those who value asset protection and are willing to navigate a more complex interface.

Gemini: Regulated Exchange for Institutional Investors

Gemini’s focus on regulatory adherence and institutional services positions it as a key player in the cryptocurrency exchange market. As a regulated exchange, Gemini provides a secure and compliant environment for institutional investors to engage in cryptocurrency trading.

Gemini in 2026

Looking ahead to 2026, Gemini is expected to continue its trajectory of growth and innovation, driven by its commitment to regulatory compliance and institutional services.

Overview

Gemini is renowned for its robust security measures and adherence to regulatory standards, making it a trusted platform among institutional investors.

Pros

- Regulatory Compliance: Gemini’s adherence to regulatory requirements provides a secure trading environment.

- Institutional Services: The platform offers tailored services for institutional investors, including custody and trading solutions.

Cons

- Limited Trading Pairs: Compared to some other exchanges, Gemini may offer fewer trading pairs.

- Fee Structure: While competitive, Gemini’s fees may be higher than some other exchanges.

Features

| Feature | Description |

|---|---|

| Security Measures | Multi-factor authentication, cold storage, and robust encryption. |

| Institutional Custody | Secure custody solutions for institutional investors. |

| Trading Solutions | Advanced trading platforms for institutional clients. |

Who Should Use Gemini

Gemini is particularly suited for institutional investors seeking a regulated exchange with robust security measures and compliant with financial regulations. Its services cater to the needs of sophisticated investors who require a high level of security and regulatory adherence.

Next-Generation Trading Exchanges Emerging in 2026

As we approach 2026, the cryptocurrency trading landscape is poised for significant transformation with the emergence of next-generation trading exchanges. These new platforms are expected to address current limitations and capitalize on technological advancements to provide a more secure, efficient, and user-friendly trading experience.

Solana-Based Exchange Platforms

Solana-based exchange platforms are gaining traction due to their high throughput and low latency. These exchanges leverage Solana’s blockchain technology to facilitate faster transaction processing times and lower fees, making them attractive to both retail and institutional traders. Key benefits include:

- High scalability

- Low transaction costs

- Fast execution times

Layer-2 Optimized Trading Solutions

Layer-2 optimized trading solutions are designed to enhance the scalability and efficiency of cryptocurrency trading. By processing transactions off the main blockchain and then settling them in batches, these solutions reduce congestion and lower costs. This approach is particularly beneficial for:

- High-frequency traders

- Large institutional investors

AI-Powered Trading Platforms

AI-powered trading platforms are revolutionizing the cryptocurrency trading landscape by incorporating advanced machine learning algorithms to analyze market data, predict trends, and execute trades. These platforms offer:

- Enhanced market analysis

- Automated trading strategies

- Personalized trading recommendations

Quantum-Resistant Exchange Security

As the threat of quantum computing looms, cryptocurrency exchanges are beginning to adopt quantum-resistant security measures. These include the implementation of quantum-resistant cryptographic algorithms and protocols to safeguard against potential quantum attacks, ensuring the long-term security of digital assets.

The emergence of these next-generation trading exchanges in 2026 is expected to significantly impact the cryptocurrency trading landscape, offering traders more sophisticated tools, enhanced security, and greater efficiency.

Decentralized Exchanges (DEXs): The Future of Trading

The decentralized exchange (DEX) ecosystem is rapidly evolving, with innovative platforms like Uniswap V6 and dYdX Autonomous Platform leading the charge towards a more decentralized trading environment. As we explore the potential of DEXs, it’s essential to understand their current developments and the challenges they face.

Uniswap V6

Uniswap V6 represents a significant upgrade in the Uniswap protocol, focusing on enhanced capital efficiency and improved user experience. Key features include:

- Optimized liquidity provision

- Reduced slippage

- Enhanced gas efficiency

These advancements position Uniswap V6 as a leading DEX, offering traders a more efficient and cost-effective trading experience.

dYdX Autonomous Platform

The dYdX Autonomous Platform is another significant player in the DEX space, known for its decentralized margin trading and lending capabilities. Its key features include:

- Decentralized governance

- High liquidity

- Advanced trading tools

dYdX is pioneering the use of decentralized protocols for margin trading, providing a robust platform for sophisticated traders.

Cross-Chain DEX Solutions

Cross-chain DEX solutions are emerging as a critical component of the decentralized trading ecosystem, enabling seamless transactions across different blockchain networks. Benefits include:

- Increased liquidity

- Enhanced interoperability

- Broader asset support

These solutions are crucial for the growth of the DEX market, as they facilitate a more interconnected and accessible trading environment.

Regulatory Compliant DEXs

As the DEX market matures, regulatory compliance is becoming increasingly important. Regulatory compliant DEXs are adapting to meet the evolving regulatory landscape, incorporating features such as:

- Know-your-customer (KYC) protocols

- Anti-money laundering (AML) measures

- Transparency reporting

These compliant DEXs are poised to bridge the gap between decentralized trading and traditional financial regulatory frameworks.

Security Considerations for Cryptocurrency Trading in 2026

Security considerations are paramount for cryptocurrency traders in 2026, with several key developments enhancing the protection of digital assets. As the cryptocurrency market continues to mature, the importance of robust security measures becomes increasingly evident.

Multi-Factor Authentication Evolution

In 2026, multi-factor authentication (MFA) has evolved to include advanced biometric verification methods, such as facial recognition and fingerprint scanning, significantly enhancing account security. Exchanges now offer MFA using behavioral biometrics, making unauthorized access more difficult.

Cold Storage Innovations

Cold storage solutions have seen significant innovations, with the introduction of hardware security modules (HSMs) that provide enhanced protection for private keys. These advancements ensure that cryptocurrencies stored offline remain secure from cyber threats.

Insurance and Asset Protection

Cryptocurrency exchanges in 2026 offer more comprehensive insurance policies to protect traders’ assets against theft and loss. Insurance coverage now includes protection against smart contract failures, providing an additional layer of security for DeFi participants.

Threat Detection and Prevention

Advanced threat detection systems utilizing artificial intelligence (AI) and machine learning (ML) are now prevalent in cryptocurrency trading platforms. These systems can identify and mitigate potential security threats in real-time, ensuring a more secure trading environment.

| Security Measure | Description | Benefit |

|---|---|---|

| Multi-Factor Authentication | Advanced biometric verification | Enhanced account security |

| Cold Storage | Hardware Security Modules (HSMs) | Secure private key storage |

| Insurance Policies | Comprehensive asset protection | Protection against theft and loss |

| Threat Detection | AI and ML-powered systems | Real-time threat mitigation |

Comparing Global Trading Exchanges for US Investors

The landscape of global trading exchanges for US investors is diverse, with platforms varying significantly in terms of fees, supported assets, and regulatory compliance. This diversity necessitates a thorough comparison to identify the most suitable exchange.

Fee Structure Comparison

Different exchanges have distinct fee structures. For instance, some exchanges charge a flat fee per transaction, while others have tiered fee systems based on trading volume. Coinbase Prime and Binance US are examples of exchanges with competitive fee structures.

Supported Assets and Trading Pairs

The range of supported assets and trading pairs varies significantly across exchanges. Kraken and Gemini offer a wide array of cryptocurrencies and trading pairs, catering to diverse investor preferences.

Regulatory Compliance Status

Regulatory compliance is crucial for US investors. Exchanges like Coinbase Prime and Gemini are known for their stringent adherence to regulatory requirements.

Advanced Trading Features

Advanced trading features, including margin trading and stop-loss orders, are offered by various exchanges. Binance US and Kraken provide sophisticated trading tools for experienced investors.

| Exchange | Fee Structure | Supported Assets | Regulatory Compliance |

|---|---|---|---|

| Coinbase Prime | Tiered | 100+ | High |

| Binance US | Competitive | 200+ | High |

| Kraken | Maker-Taker | 150+ | High |

Conclusion: Choosing the Right Cryptocurrency Exchange in 2026

As the cryptocurrency market continues to evolve in 2026, selecting the right trading exchange is crucial for both novice and experienced traders. The sources collectively provide a comprehensive overview of the cryptocurrency trading landscape, highlighting key factors to consider when choosing a cryptocurrency exchange.

When evaluating trading exchanges, it’s essential to consider factors such as security protocols, fee structures, and user experience. Exchanges like Coinbase Prime, Binance US, Kraken, and Gemini offer unique features catering to different trading needs. The emerging next-generation trading exchanges, including Solana-based platforms and AI-powered trading solutions, are also worth considering.

In the rapidly changing digital assets marketplace, an online trading platform’s ability to adapt to regulatory requirements and technological advancements is vital. By understanding your individual trading needs and preferences, you can make an informed decision when choosing a cryptocurrency exchange in 2026.

Ultimately, the right exchange for you will depend on your specific requirements, whether you’re a seasoned trader or just starting out. By carefully evaluating the available options and staying informed about the latest developments in the cryptocurrency market, you can navigate the complex world of cryptocurrency trading with confidence.

FAQ

What are the key factors to consider when choosing a cryptocurrency trading exchange in 2026?

When selecting a cryptocurrency trading exchange, consider factors such as security measures, fee structures, user experience, regulatory compliance, and available trading pairs to ensure a reliable and efficient trading experience.

How will regulatory changes impact cryptocurrency trading exchanges in 2026?

Regulatory changes are expected to shape the cryptocurrency market in 2026, with a focus on increased oversight, anti-money laundering (AML) and know-your-customer (KYC) compliance, and clearer guidelines for trading and custody.

What are the benefits of using a decentralized exchange (DEX) for cryptocurrency trading?

Decentralized exchanges offer benefits such as increased security, transparency, and autonomy, as well as reduced reliance on intermediaries, but may also present challenges related to liquidity, usability, and regulatory compliance.

How do Coinbase Prime, Binance US, Kraken, and Gemini differ in terms of their services and target user base?

Coinbase Prime is geared towards institutional investors, Binance US offers a comprehensive trading platform for US-based traders, Kraken is known for its robust security features, and Gemini is a regulated exchange catering to institutional investors, each with unique features and advantages.

What security measures should I look for when evaluating a cryptocurrency trading exchange?

When assessing a cryptocurrency trading exchange, look for security measures such as multi-factor authentication, cold storage solutions, insurance policies, and robust threat detection and prevention systems to protect your assets.

How do trading fees and costs vary across different cryptocurrency exchanges?

Trading fees and costs can differ significantly across exchanges, with some charging percentage-based fees, while others may have fixed fees or tiered structures, so it’s essential to understand the fee structure before choosing an exchange.

What are the emerging trends in cryptocurrency trading exchanges expected to shape the industry in 2026?

Emerging trends include the rise of decentralized exchanges, layer-2 optimized trading solutions, AI-powered trading platforms, and quantum-resistant exchange security, which are expected to enhance the efficiency, security, and accessibility of cryptocurrency trading.

How can I compare global trading exchanges relevant to US investors?

To compare global trading exchanges, consider factors such as fee structures, available assets and trading pairs, regulatory compliance status, and advanced trading features to determine the best fit for your individual needs and preferences.

What is the significance of regulatory compliance for cryptocurrency trading exchanges?

Regulatory compliance is crucial for cryptocurrency trading exchanges, as it ensures adherence to AML and KYC regulations, protects users’ assets, and maintains the integrity of the financial system, ultimately contributing to a more secure and trustworthy trading environment.

What are the advantages of using a cryptocurrency trading platform with advanced trading features?

Advanced trading features, such as margin trading, stop-loss orders, and technical analysis tools, can enhance your trading experience, allowing for more sophisticated strategies and better risk management, but may also require a higher level of trading expertise.