Binance Trading History: Earn $1000 with This Guide

Binance Trading History: Earn $1000 with This Guide

Binance Trading History: Earn $1000 with This Guide

Can you really earn $1000 through cryptocurrency trading on Binance? With the altcoin market capitalization dropping by 15%, the crypto market has been quite turbulent. Understanding your Binance trading history is crucial for navigating these market fluctuations and achieving your financial goals. Binance Trading

The cryptocurrency market is known for its volatility, making it essential for traders to have a comprehensive understanding of their trading activities on platforms like Binance. By analyzing your trading history, you can identify successful strategies and areas for improvement, ultimately enhancing your cryptocurrency trading skills.

This guide is designed to help you navigate the Binance platform effectively, make informed decisions based on your trading history, and work towards earning $1000. By the end of this guide, you’ll be equipped with the knowledge and strategies necessary to succeed in the cryptocurrency market.

Key Takeaways

- Understand the importance of analyzing your Binance trading history.

- Learn strategies to navigate the volatile cryptocurrency market.

- Discover how to make informed decisions based on your trading activities.

- Find out how to work towards earning $1000 on Binance.

- Gain insights into enhancing your cryptocurrency trading skills.

Understanding Binance: The World’s Leading Cryptocurrency Exchange

As the world’s leading cryptocurrency exchange, Binance has garnered significant attention for its diverse cryptocurrency offerings and user-friendly interface. Binance’s rise to prominence in the cryptocurrency market is a result of its commitment to providing a secure, reliable, and feature-rich trading platform.

The Rise of Binance in the Crypto Market

Binance’s ascent in the crypto market can be attributed to its innovative approach to cryptocurrency trading. Founded with the goal of providing a comprehensive trading platform, Binance has expanded its offerings to include a wide range of cryptocurrencies, altcoin trading options, and advanced trading tools. This expansion has made it a one-stop-shop for cryptocurrency traders worldwide.

The exchange’s focus on robust security measures, including multi-factor authentication and cold storage solutions, has instilled confidence in its users, contributing to its rapid growth.

Key Features That Set Binance Apart

Several key features distinguish Binance from other cryptocurrency exchanges. These include its user-friendly interface, which simplifies navigation and trading, and its diverse cryptocurrency offerings, which cater to a broad range of trading interests.

| Feature | Description | Benefit |

|---|---|---|

| Advanced Trading Tools | Binance offers a variety of trading tools, including limit orders, stop-limit orders, and margin trading. | Enhances trading flexibility and strategy execution. |

| Multi-Language Support | The platform is available in multiple languages, making it accessible to a global user base. | Facilitates international trading and user engagement. |

| Robust Security | Binance employs advanced security measures, including two-factor authentication and encryption. | Protects user accounts and assets. |

Additionally, Binance’s mobile app allows users to trade on-the-go, further enhancing its appeal to active traders. By continually updating and expanding its features, Binance remains at the forefront of the cryptocurrency exchange market.

Trading History and Earning $1000 on Binance: An Overview

Understanding your trading history is pivotal to making informed decisions on Binance. By analyzing your past trades, you can identify patterns, strengths, and weaknesses in your trading strategy. This insight is crucial for refining your approach and achieving your financial goals.

The Importance of Trading History for Profitable Decisions

Your trading history serves as a roadmap to understanding your performance on Binance. It highlights successful trading strategies and areas that need improvement. By reviewing your trading history, you can:

- Identify profitable trends and patterns

- Adjust your strategy to minimize losses

- Make informed decisions based on data

This analytical approach is essential for creating a crypto earnings guide tailored to your needs. It enables you to track your trader portfolio growth and make adjustments as necessary.

Setting Realistic Earnings Goals on Binance

Setting realistic earnings goals is vital for achieving success on Binance. By understanding your trading history, you can set achievable targets, such as earning $1000. To do this effectively, consider the following:

- Assess your current trading performance

- Determine a realistic timeline for achieving your goal

- Develop a strategy to reach your target

By following these steps and continually reviewing your trading history, you can create a clear path to achieving your financial objectives on Binance.

Getting Started with Binance: Account Setup and Navigation

The first step to trading on Binance is setting up your account, a process designed to be straightforward and secure. To begin, you’ll need to sign up on the Binance platform, which requires basic information such as your email address or phone number, and a strong password.

Creating and Securing Your Binance Account

To create a Binance account, navigate to the Binance website or download the Binance app. You’ll be prompted to enter your email address or phone number and create a password. It’s crucial to use a strong password and enable two-factor authentication (2FA) to secure your account. 2FA adds an extra layer of security, making it harder for unauthorized users to access your account.

Understanding the Binance User Interface

Once your account is set up, you’ll be introduced to the Binance user interface. The dashboard is designed to be intuitive, with various sections such as the trading platform, wallet, and market data. Familiarize yourself with these sections to navigate Binance efficiently. The trading platform is where you’ll execute trades, while the wallet section allows you to deposit, withdraw, and manage your cryptocurrencies.

Deposit Options and Funding Your Account

To start trading, you need to deposit funds into your Binance account. Binance supports various deposit options, including cryptocurrencies and fiat currencies through specific payment methods. Navigate to the ‘Wallet’ section, select ‘Deposit,’ and follow the instructions for your chosen deposit method. Ensure you’re using the correct deposit address to avoid any loss of funds.

Essential Binance Trading Tools and Features

The Binance trading platform is equipped with a variety of features that cater to both novice and experienced traders. Understanding these tools is crucial for maximizing trading profits on the Binance exchange.

Spot Trading vs. Futures Trading on Binance

Binance offers two primary trading options: Spot Trading and Futures Trading. Spot Trading involves buying and selling cryptocurrencies at the current market price, allowing for straightforward transactions. On the other hand, Futures Trading enables traders to speculate on the future price of cryptocurrencies, using leverage to potentially amplify gains.

Futures trading on Binance provides advanced features such as leverage and hedging, allowing traders to manage risk and capitalize on market volatility. It’s essential for traders to understand the differences between these trading types to choose the strategy that best suits their goals and risk tolerance.

Leveraging Binance’s Advanced Trading Tools

Binance’s trading platform is equipped with advanced tools designed to enhance trading strategies. Two key features are:

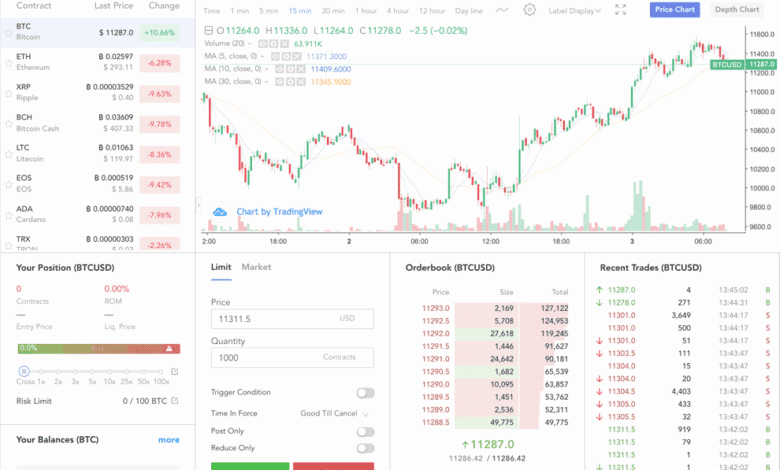

Chart Analysis Tools

Binance provides comprehensive chart analysis tools, enabling traders to conduct technical analysis and make informed decisions. These tools include various chart types, indicators, and drawing tools.

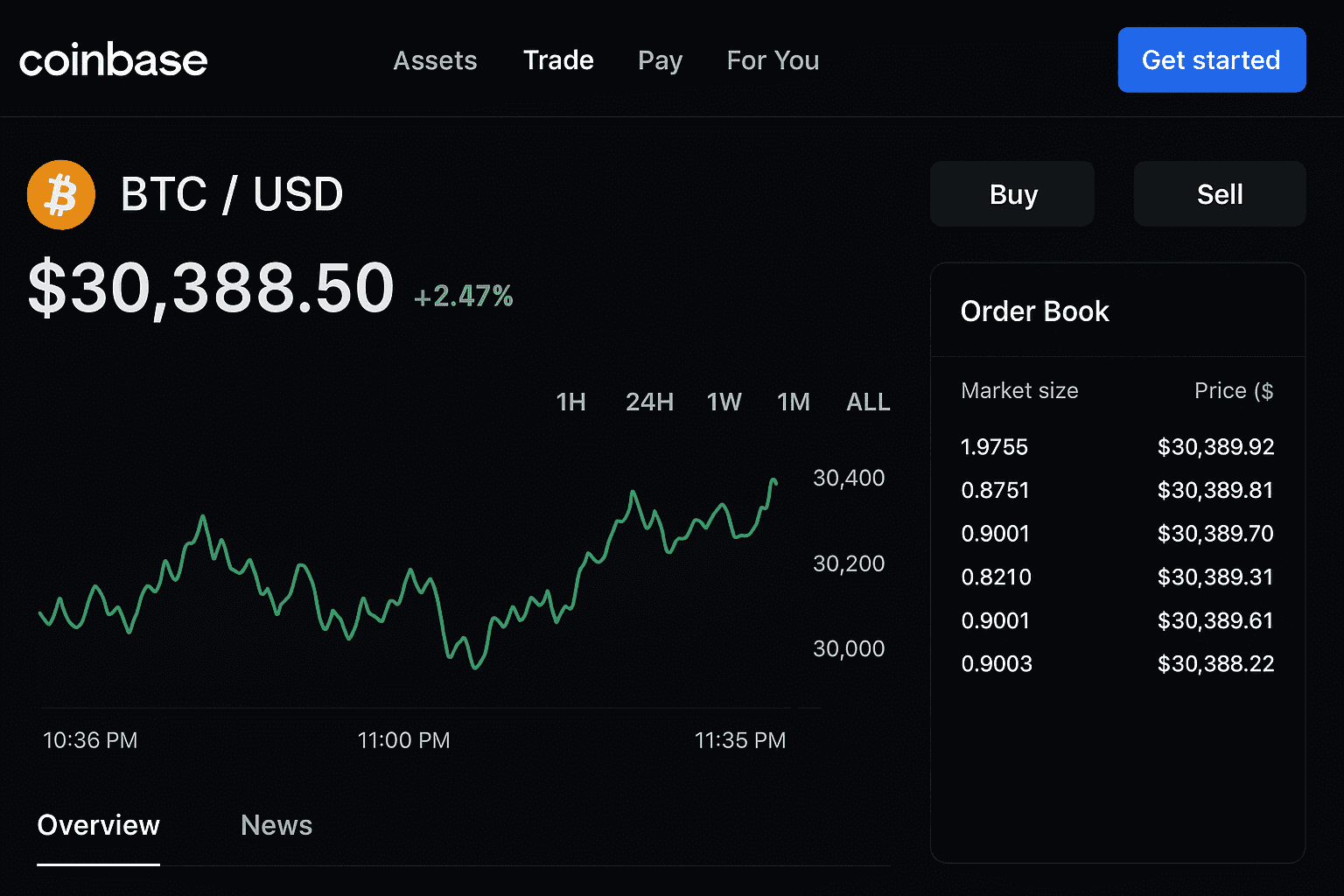

Order Book and Trade History

The Order Book and Trade History features on Binance offer valuable insights into market dynamics. The Order Book displays current buy and sell orders, while Trade History provides a record of past transactions, helping traders analyze market trends.

Traders can leverage these tools to:

- Analyze market sentiment

- Identify trends and patterns

- Make data-driven trading decisions

Using Binance’s Mobile App for On-the-Go Trading

Binance’s mobile app allows traders to monitor and manage their trades on the go. The app offers a user-friendly interface, real-time market updates, and push notifications, ensuring that traders can respond quickly to market changes.

By utilizing Binance’s mobile app, traders can stay connected to the market and adjust their strategies as needed, even when they’re not at their desktop.

In conclusion, Binance’s array of trading tools and features is designed to support traders in achieving their goals. By understanding and leveraging these tools, traders can enhance their trading experience and potentially increase their profits.

Developing a $1000 Earning Strategy on Binance

Earning $1000 on Binance is achievable with a thoughtful and informed trading strategy. Developing a successful approach requires careful consideration of various factors, including cryptocurrency selection, market trends, and risk management.

Selecting the Right Cryptocurrencies for Your Portfolio

Choosing the right cryptocurrencies is crucial for a profitable trading strategy on Binance. Traders need to consider several factors when selecting coins for their portfolio.

Major Coins vs. Altcoins

Major coins like Bitcoin and Ethereum are generally considered more stable, while altcoins can offer higher potential returns but come with increased risk. A balanced portfolio might include a mix of both.

Market Cap and Volume Considerations

Market capitalization and trading volume are key indicators of a cryptocurrency’s stability and liquidity. Coins with higher market caps and volumes tend to be less volatile.

Day Trading vs. Long-term Investment Approaches

Traders on Binance can choose between day trading and long-term investment strategies. Day trading involves making multiple trades within a day to capitalize on short-term price movements, while long-term investing focuses on holding assets over a longer period.

“The biggest risk is not taking any risk,” as Mark Zuckerberg once said. This quote emphasizes the importance of taking calculated risks in trading.

Setting Up Strategic Entry and Exit Points

Setting strategic entry and exit points is vital for maximizing profits and minimizing losses. This involves using various order types to manage trades effectively.

Using Stop-Loss and Take-Profit Orders

Stop-loss orders automatically sell a cryptocurrency when it falls to a certain price, limiting potential losses. Take-profit orders sell a cryptocurrency when it reaches a certain profit level, securing gains.

Trailing Stops and OCO Orders

Trailing stops adjust the stop-loss price as the market price moves, allowing traders to lock in profits while giving the trade room to grow. OCO (One Cancels the Other) orders allow traders to set two orders simultaneously, with one canceling the other when executed.

By combining these strategies, traders can develop a robust trading plan on Binance. As strategies for earning on Binance continue to evolve, staying informed and adapting to market changes is crucial for crypto trading success.

Ultimately, achieving Binance profits requires a blend of knowledge, strategy, and risk management. By following these guidelines, traders can enhance their chances of earning $1000 or more on the platform.

Advanced Trading Techniques for Maximizing Profits

To maximize profits on Binance, traders must employ advanced trading techniques that go beyond basic buying and selling. These techniques enable traders to make informed decisions, manage risk, and capitalize on market opportunities.

Technical Analysis Fundamentals for Binance Trading

Technical analysis is a critical component of successful trading on Binance. It involves analyzing historical price data and chart patterns to predict future price movements. By understanding technical analysis, traders can identify trends and patterns that inform their trading decisions.

Key Chart Patterns to Recognize

Traders should be familiar with key chart patterns such as trends, reversals, and continuations. These patterns provide insights into market sentiment and potential price movements, enabling traders to make more informed decisions.

Essential Indicators for Decision Making

Technical indicators such as moving averages, Relative Strength Index (RSI), and Bollinger Bands are essential tools for traders. They help in identifying trends, measuring volatility, and making informed trading decisions.

Implementing Effective Risk Management Strategies

Risk management is vital for protecting trading capital and ensuring long-term success on Binance. Effective risk management involves setting stop-loss orders, limiting position sizes, and diversifying portfolios. By managing risk, traders can minimize losses and maximize gains.

Utilizing Binance’s Order Types to Your Advantage

Binance offers various order types that can be leveraged to enhance trading strategies. Understanding how to use limit orders, stop-limit orders, and market orders can help traders execute their plans more effectively.

Real Success Stories: Traders Who Earned $1000+ on Binance

The success stories of traders on Binance are a testament to the platform’s potential for generating substantial earnings. Many have achieved financial milestones, and their experiences offer valuable insights for aspiring traders.

Case Study 1: Successful Day Trading Strategy

A notable example is a trader who employed a day trading strategy, focusing on volatile cryptocurrencies. By leveraging Binance’s advanced trading tools, this trader was able to capitalize on market fluctuations, earning over $1000 in a single week.

“The key to my success was staying informed and adapting quickly to market changes,” the trader noted.

Case Study 2: Long-term Investment Approach

Another trader opted for a long-term investment strategy, diversifying their portfolio across various cryptocurrencies on Binance. This approach allowed them to ride out market volatility and achieve significant returns over time.

Lessons Learned from Successful Traders

Successful traders on Binance emphasize the importance of risk management and continuous learning. A summary of their strategies is presented in the table below:

| Strategy | Key Elements | Outcome |

|---|---|---|

| Day Trading | Market analysis, quick decision-making | $1000+ earnings |

| Long-term Investment | Diversification, patience | Significant returns over time |

These success stories demonstrate that, with the right strategy and tools, traders can achieve their financial goals on Binance.

Tracking and Analyzing Your Trading Performance

Analyzing your trading performance is a key step in optimizing your trading strategy on Binance. To achieve consistent profitability, it’s crucial to understand how to effectively track and analyze your trading activities.

Using Binance’s Trading History and Reports

Binance provides a comprehensive trading history and various reports that can be instrumental in analyzing your trading performance. By leveraging these tools, you can gain insights into your trading habits and identify areas for improvement.

Interpreting Your Trading Data

Interpreting your trading data involves understanding metrics such as profit/loss ratios, trading volumes, and the performance of specific cryptocurrencies. This analysis helps in making informed decisions to adjust your trading strategy.

Identifying Patterns in Your Trading Behavior

By examining your trading history, you can identify patterns in your trading behavior, such as tendencies to overtrade or make impulsive decisions. Recognizing these patterns allows you to take corrective actions to improve your trading discipline.

Third-party Tools for Enhanced Performance Analysis

In addition to Binance’s built-in tools, third-party platforms can offer advanced analytics and reporting features. These tools can provide a more detailed analysis of your trading performance, helping you refine your strategies.

Setting Performance Benchmarks and Goals

Setting clear performance benchmarks and goals is essential for evaluating your trading success. By establishing specific targets, you can measure your progress and make necessary adjustments to stay on track.

To improve trading results, it’s vital to regularly review and adjust your trading strategy based on your performance analysis. By doing so, you can optimize your approach to trading on Binance and work towards achieving your financial goals.

Effective trading performance tracking and analysis are ongoing processes that require consistent effort and attention. By leveraging the tools and techniques discussed, you can enhance your trading performance and maximize your profits on Binance.

Conclusion: Your Pathway to Successful Trading on Binance

Achieving financial goals through Binance trading requires a combination of knowledge, strategy, and adaptability. By following the strategies and techniques outlined in this guide, traders can maximize their earnings on Binance and navigate the ever-changing cryptocurrency market.

To succeed, it’s essential to stay informed about market trends and continuously refine your trading skills. Implementing successful trading strategies and leveraging Binance trading tips can help you make informed decisions and optimize your trading performance.

As the cryptocurrency market continues to evolve, it’s crucial to remain adaptable and responsive to changes. By doing so, you can ensure long-term success and achieve your financial goals through Binance trading.

FAQ

What is Binance and how does it work?

Binance is a leading cryptocurrency exchange that allows users to buy, sell, and trade various cryptocurrencies. It provides a platform for traders to exchange their assets and offers advanced trading tools and features.

How do I create and secure my Binance account?

To create a Binance account, go to the Binance website, sign up, and follow the verification process. To secure your account, enable two-factor authentication, use a strong password, and keep your login credentials confidential.

What are the best trading strategies for earning $1000 on Binance?

Successful trading strategies on Binance include day trading, long-term investment, and swing trading. It’s essential to develop a well-thought-out strategy, manage risk, and stay informed about market trends.

How can I track my trading performance on Binance?

Binance provides a trading history and reports that allow you to track your performance. You can also use third-party tools to analyze your trading data and set performance benchmarks.

What are the key features that set Binance apart from other cryptocurrency exchanges?

Binance offers advanced trading tools, a wide range of cryptocurrencies, high liquidity, and robust security measures, making it a preferred choice among traders.

How do I deposit funds into my Binance account?

To deposit funds into your Binance account, go to the ‘Deposit’ section, select the cryptocurrency or fiat currency you want to deposit, and follow the instructions provided.

What is the difference between spot trading and futures trading on Binance?

Spot trading involves buying and selling cryptocurrencies at the current market price, while futures trading involves trading contracts that speculate on the future price of a cryptocurrency.

How can I use technical analysis to improve my trading decisions on Binance?

Technical analysis involves analyzing charts and patterns to predict future price movements. You can use technical indicators and charting tools on Binance to make informed trading decisions.

What are some common mistakes to avoid when trading on Binance?

Common mistakes to avoid include over-trading, failing to manage risk, and not staying informed about market trends. It’s essential to develop a trading plan and stick to it.

How can I maximize my profits on Binance?

To maximize profits on Binance, use advanced trading tools, manage risk, and stay informed about market trends. It’s also essential to develop a well-thought-out trading strategy and adjust it as needed.

What are the benefits of using Binance’s mobile app for trading?

Binance’s mobile app allows you to trade on-the-go, access real-time market data, and receive notifications about your account activity, making it easier to stay on top of your trading.

How can I stay up-to-date with the latest market trends and news on Binance?

You can stay informed about market trends and news on Binance by following reputable sources, such as cryptocurrency news websites and social media channels, and participating in online communities.