Best Crypto AI Trading Bots of 2026

best AI trading bots for crypto in 2026. Compare 3Commas, Pionex, Cryptohopper, and Bitsgap with expert analysis of features, pricing, security, and risks.

The Best Crypto AI Trading Bots of 2026: A Complete Guide

Crypto trading bots can feel like power tools—they make hard jobs faster and cleaner, but they don’t turn anyone into a master builder overnight. Bots automate execution and discipline, but they don’t create an edge by themselves.

The question you should be asking is: which bot should I use, and what can go wrong? In this guide, I’ll go beyond glossy feature lists to help you understand what AI trading bots really are, how they differ from traditional bots, and which platforms deserve your attention in 2026.

Critical Reality Check: AI trading bots optimize around historical patterns. When market conditions change,

AI Trading Bots Comparison

Quick Comparison: Top AI Trading Bots 2026

| Platform | Best For | Starting Price (Monthly) | AI Features | Exchanges | Beginner-Friendly | Paper Trading |

|---|---|---|---|---|---|---|

| 3Commas | Multi-exchange traders with hands-on management | $12.42/month | AI assistant for entry/exit suggestions, trend analysis | Binance, Bybit, OKX, Coinbase, Kraken, KuCoin | Medium | Yes |

| Pionex | Complete beginners, one-exchange users | $0 (fee-based only) | PionexGPT – plain English bot configuration | Pionex exchange only | Very High | Demo mode |

| Cryptohopper | Strategy marketplace, frequent strategy switching | Free – $24.16/month | Algorithm Intelligence – strategy scoring & rotation | Binance, Bybit, OKX, Coinbase, Kraken, KuCoin | Medium | Yes |

| Bitsgap | Multi-exchange terminal users | basic plan $23/month | AI Assistant for parameter suggestions, portfolio grouping | Binance, Bybit, OKX, Coinbase, Kraven, KuCoin, Bitget | Medium | Yes |

| HaasOnline | Advanced traders & developers | $16.79/month (coming soon) | Scripting-focused, not AI-driven | Binance, Bybit, OKX, Kraken, KuCoin, Bitget | Low | Yes |

| Coinrule | No-code rule builders | Free – $29.99/month | AI Trading for adaptive optimization | Binance, OKX, Bybit, Bitget, Coinbase, Kraken | High | Demo exchange |

| TradeSanta | Template-first, quick setup | $18/month | Rule-based automation only | 9 Major Binance, Kraken, OKX, Huobi, HitBTC | Medium | Yes |

Detailed Features Breakdown

| Feature | 3Commas | Pionex | Cryptohopper | Bitsgap | HaasOnline | Coinrule | TradeSanta |

|---|---|---|---|---|---|---|---|

| Grid Trading | ✅ | ✅ | ❌ | ✅ | ✅ | ❌ | ✅ |

| DCA Bots | ✅ | ✅ | ❌ | ✅ | ✅ | ❌ | ❌ |

| Custom Scripting | ❌ | ❌ | ❌ | ❌ | ✅ | ❌ | ❌ |

| Strategy Marketplace | ❌ | ❌ | ✅ | ❌ | ❌ | ✅ | ✅ |

| TradingView Alerts | ✅ | ❌ | ✅ | ❌ | ✅ | ✅ | ✅ |

| Copy Trading | ❌ | ✅ | ✅ | ❌ | ❌ | ❌ | ❌ |

| Futures Trading | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ❌ |

| Mobile App | ✅ | ✅ | ✅ | ✅ | ❌ | ✅ | ✅ |

| API Security Features | Trade-only keys, IP whitelist | Trade-only keys | Trade-only keys, IP whitelist | Trade-only keys, IP whitelist | Trade-only keys | Trade-only keys | Trade-only keys |

Pricing Comparison (Annual Plans)

| Platform | Free Tier | Basic | Advanced | Premium |

|---|---|---|---|---|

| 3Commas | ❌ | $12.42/mo | $30/mo | $91.58/mo |

| Pionex | ✅ (Fee-based) | Spot: 0.05% | Leverage: 0.10% | Futures: 0.02% |

| Cryptohopper | ✅ | $24.16/mo | $57.50/mo | $107.50/mo |

| Bitsgap | ❌ | $23/mo | $55/mo | $121/mo |

| HaasOnline | ❌ | $16.79/mo* | $41.99/mo* | $125.99/mo |

| Coinrule | ✅ | $29.99/mo | $59.99/mo | $749/mo |

| TradeSanta | ❌ | $18/mo | $32/mo | $45/mo |

Use Case Matcher

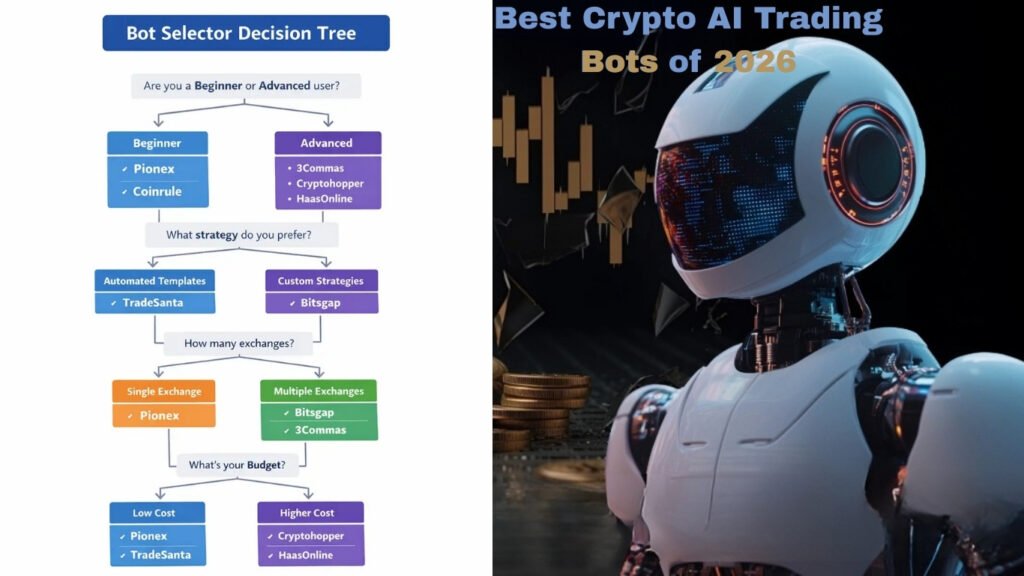

Choose 3Commas if: You trade on multiple exchanges and want SmartTrade workflows with signal routing and active position management.

Choose Pionex if: You’re a complete beginner who wants built-in bots with minimal complexity and no subscription fees.

Choose Cryptohopper if: You prefer using pre-made strategies from a marketplace and want automated strategy switching based on market conditions.

Choose Bitsgap if: You need to manage positions across many exchanges from one unified terminal with AI-assisted configuration.

Choose HaasOnline if: You have coding skills and want complete control over custom logic, market making, or arbitrage strategies.

Choose Coinrule if: You want to build “if-then” rules visually without any programming knowledge.

Choose TradeSanta if: You want simple template-based bots with quick cloud setup and minimal configuration.

Note: All pricing data sourced as of January 2, 2026. Always verify current pricing on official platforms before subscribing.

Security Checklist:

Trade-Only Keys: Enable trade-only permissions with no withdrawal rights Two-Factor Authentication: On both the bot account and exchange IP Whitelisting: Restrict keys to approved addresses where supported Separate Read-Only Keys: For monitoring dashboards Monthly Audits: Regular key rotation to limit exposure Immediate Revocation: Of any unused or suspicious permissions

Treat API keys like passwords and minimize what each key can do.

How to Choose the Right Bot

The right bot fits your goals, risk tolerance, and market conditions you plan to trade.

Define Your Parameters:

Time Horizon: Short-term traders need tighter controls than long-term accumulators Market Type: Spot avoids leverage and is simpler for beginners; futures enable hedging but add complexity Involvement Level: Decide if you want hands-on setup or hands-off routine

Match Strategy to Conditions:

Ranging Markets: Grid trading suits sideways price action Accumulation: Dollar-cost averaging spreads entries over time Price Gaps: Arbitrage looks for differences across venues (sensitive to fees and latency)

Validate Before Scaling:

Always use backtesting with realistic fees and slippage included. Practice live flow with paper trading to surface order handling issues before risking real capital.

Ready to put theory into practice? Start with Complete Guide to Automated Trading 2026 and build from a safe foundation.

Frequently Asked Questions

Q: Can AI trading bots guarantee profits? A: No. AI trading bots cannot guarantee profits. They optimize around historical patterns and can fail when market conditions change. They’re tools to improve efficiency and execution, not magic profit machines. Always use proper risk management and never invest more than you can afford to lose.

Q: What’s the difference between free and paid trading bots? A: Paid platforms offer convenience, reliable uptime, customer support, and safety features with native integrations. Free platforms (like Pionex’s built-in bots or open-source Hummingbot) require more technical knowledge and self-hosting but offer maximum control and transparency. Choose paid for speed and support, free for flexibility and full control.

Q: How much should I start with when using AI trading bots? A: Start with small amounts you can afford to lose completely. Use paper trading or demo modes first, then begin live trading with minimal capital (perhaps $100-500) to validate the bot’s behavior. Only scale up after consistent positive results over multiple market conditions.

Conclusion

AI trading bots represent a significant advancement in crypto trading automation, offering 24/7 coverage, time savings, emotional control, and reduced errors. However, they come with real risks including AI errors, idea crowding, security vulnerabilities, and the potential to over-complicate strategies.

The key is treating these tools as assistants rather than replacements for human judgment. Start small, validate strategies through backtesting and paper trading, implement strict security measures, and maintain active oversight.

Whether you choose a beginner-friendly platform like Pionex, a multi-exchange solution like 3Commas or Bitsgap, or a marketplace-driven option like Cryptohopper, success depends on matching the tool to your goals, understanding its limitations, and maintaining disciplined risk management.

Automation doesn’t replace oversight—it enhances execution when used responsibly.