Bullish Crypto Market: Active Trading Edge

Bullish crypto market.The current crypto market is exhibiting a broad bullish trend, with Bitcoin and Ethereum at the forefront of this surge.

As the cryptocurrency trends continue to evolve, active trading strategies are becoming increasingly important for capitalizing on the uptrend. Traders and investors are seeking effective crypto trading strategies to maximize their gains in this dynamic environment.

Key Takeaways

- Understanding the current bullish trend in digital assets is crucial for traders.

- Active trading strategies can help capitalize on the uptrend.

- Leading cryptocurrencies like Bitcoin and Ethereum are driving the market.

- Staying informed about cryptocurrency trends is essential for making informed decisions.

- Effective crypto trading strategies can maximize gains.

The Anatomy of a Bullish Crypto Market

A bullish crypto market is characterized by a complex interplay of factors, including increased adoption and positive market sentiment. As the cryptocurrency market continues to mature, understanding these dynamics is crucial for investors seeking to capitalize on emerging trends.

Key Indicators of a Crypto Bull Run

Several key indicators signal the onset of a crypto bull run, including increased trading volume and positive market sentiment. Historical data shows that cryptocurrency bull runs are often accompanied by increased adoption and positive market sentiment.

- Rising prices driven by increased demand

- Improved market sentiment reflected in investor attitudes

- Mainstream adoption and media coverage

Historical Patterns in Cryptocurrency Bull Markets

Analyzing historical patterns in cryptocurrency bull markets provides valuable insights into their evolution. Past bull runs have shown that market cycles are influenced by a combination of technological advancements, regulatory developments, and macroeconomic trends.

| Year | Bull Run Characteristics | Key Drivers |

|---|---|---|

| 2017 | Rapid price increase, high speculation | ICO boom, media coverage |

| 2020-2021 | Institutional investment, DeFi growth | COVID-19 pandemic, institutional adoption |

Understanding these patterns can help investors better navigate the complexities of the cryptocurrency market and make more informed decisions.

Active vs. Passive Trading in Cryptocurrency

As the cryptocurrency market continues its upward trend, traders are faced with a critical decision: whether to adopt an active or passive trading strategy. This choice is crucial in maximizing returns and managing risk in a volatile market.

Defining Active Trading Approaches

Active trading involves frequent buying and selling of cryptocurrencies to capitalize on short-term price movements. This approach requires a deep understanding of market trends, technical analysis, and the ability to make quick decisions. Active traders aim to outperform the market by leveraging their knowledge and experience.

Passive Investment Strategies

Passive investment strategies, on the other hand, involve a long-term approach, where investors hold onto their assets regardless of short-term market fluctuations. This method is based on the belief that the cryptocurrency market will continue to grow over time. Passive investors benefit from reduced transaction costs and lower stress levels, as they are not constantly monitoring the market.

Comparative Advantages in Bull Markets

In a bullish market, active trading strategies have been shown to outperform passive strategies due to their ability to capitalize on volatility. According to recent data, active traders can potentially achieve higher returns by leveraging market trends and adjusting their strategies accordingly.

| Strategy | Advantages | Disadvantages |

|---|---|---|

| Active Trading | Potential for higher returns, flexibility in volatile markets | Higher transaction costs, requires constant market monitoring |

| Passive Investing | Lower transaction costs, reduced stress levels | Potential for lower returns, vulnerability to market downturns |

Essential Technical Analysis for Bull Market Trading

In the realm of cryptocurrency trading, technical analysis stands as a crucial tool for navigating the complexities of a bullish market. Traders rely on various technical indicators and chart patterns to predict future price movements and identify potential trading opportunities.

Key Chart Patterns During Uptrends

Certain chart patterns have proven to be particularly useful in identifying potential breakouts during uptrends. Ascending triangles and cup and handle patterns are among the most significant formations that traders look for.

Ascending Triangles and Cup and Handle Patterns

Ascending triangles are characterized by a flat top and a rising bottom, indicating increasing buying pressure. The cup and handle pattern, on the other hand, represents a temporary pause in the uptrend, followed by a continuation of the upward movement. Both patterns are considered bullish signals.

Identifying Valid Breakouts

To confirm a valid breakout, traders often look for increased volume and a decisive move beyond the pattern’s boundaries. It’s essential to wait for confirmation before entering a trade to avoid false breakouts.

Momentum Indicators for Bull Markets

Momentum indicators play a crucial role in assessing the strength of a trend. Indicators such as the Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) help traders gauge whether a cryptocurrency is overbought or oversold, and whether the momentum is increasing or decreasing.

- The RSI measures the magnitude of recent price changes to determine overbought or oversold conditions.

- The MACD indicator helps identify changes in the strength, direction, and momentum of a trend.

Volume Analysis in Upward Trends

Volume analysis is another critical component of technical analysis. Increasing volume during an uptrend is generally seen as a confirmation of the trend’s strength. Conversely, decreasing volume may indicate a weakening trend. Traders use volume analysis in conjunction with other indicators to make more informed trading decisions.

By combining these technical analysis tools, traders can develop a more comprehensive understanding of the market and improve their chances of success in a bullish crypto environment.

Fundamental Analysis in a Bullish Crypto Environment

Fundamental analysis plays a pivotal role in navigating the complexities of a bullish crypto environment. It involves evaluating various factors that could influence the price of cryptocurrencies, helping investors make informed decisions.

Project Development Milestones

One crucial aspect of fundamental analysis is tracking project development milestones. Positive developments, such as new partnerships, technological advancements, and the successful implementation of roadmap objectives, can significantly drive price increases. For instance, the integration of new technologies or the expansion of a project’s ecosystem can enhance its value proposition, attracting more investors.

Institutional Adoption Signals

Institutional adoption is another key indicator of a project’s potential for growth. Signals of institutional interest, such as investments from venture capital firms or the involvement of major financial institutions, can boost a project’s credibility and attractiveness. This, in turn, can lead to increased demand and higher prices for the associated cryptocurrency.

Regulatory Impact Assessment

Regulatory changes and government policies can have a profound impact on cryptocurrency prices. A thorough regulatory impact assessment helps investors understand the potential risks and opportunities arising from new regulations. For example, favorable regulations can provide a boost to cryptocurrency adoption, while stringent regulations might deter investment.

| Factor | Impact on Crypto Price | Investor Response |

|---|---|---|

| Project Development Milestones | Positive developments drive price increases | Invest in projects with significant milestones |

| Institutional Adoption Signals | Increased credibility and demand | Follow institutional investment trends |

| Regulatory Impact Assessment | Regulatory changes can boost or hinder adoption | Stay informed about regulatory developments |

Navigating the Bullish Crypto Market: Timing Strategies

Navigating the crypto market during a bull run requires precise timing and strategic planning. Traders must be adept at identifying optimal entry and exit points to maximize their returns.

Entry Point Identification

Identifying the right entry point is crucial in a bull market. Traders can use technical analysis tools such as chart patterns and momentum indicators to determine when to enter the market. For instance, a breakout above a resistance level can signal a good entry point.

Key strategies for entry point identification include:

- Monitoring chart patterns like ascending triangles or bullish wedges

- Using momentum indicators such as the RSI or MACD to confirm uptrends

- Analyzing trading volumes to ensure they support the price movement

Profit-Taking Methodologies

Profit-taking is an essential aspect of trading in a bull market. Traders need to have a clear strategy for when to take profits to avoid giving back gains. This can involve setting target price levels or using trailing stops.

“The key to successful trading is not just about making the right calls, but also about managing your profits effectively.”

A well-structured profit-taking strategy might include:

| Strategy | Description | Benefits |

|---|---|---|

| Target Price Levels | Setting specific prices at which to sell | Locks in profits |

| Trailing Stops | Adjusting stop-loss orders as price moves | Protects against downturns |

Avoiding the FOMO Trap

The fear of missing out (FOMO) can lead traders to make impulsive decisions, often resulting in buying at peak prices. To avoid this, traders should stick to their trading plans and avoid making emotional decisions.

By maintaining a disciplined approach and using data-driven strategies, traders can navigate the bullish crypto market effectively and maximize their profits.

Risk Management During Crypto Bull Runs

The crypto market’s notorious volatility underscores the importance of implementing sound risk management practices. As the market experiences rapid price fluctuations, traders must be prepared to mitigate potential losses while maximizing gains.

Position Sizing Techniques

Position sizing is a critical aspect of risk management, as it determines the amount of capital allocated to a particular trade. Effective position sizing involves assessing the trader’s risk tolerance, setting appropriate stop-loss levels, and allocating capital accordingly. By doing so, traders can limit their exposure to potential losses and avoid over-leveraging their accounts.

Stop-Loss Strategies in Volatile Markets

In volatile markets, stop-loss orders serve as a crucial tool for limiting potential losses. A stop-loss order automatically closes a position when the price reaches a predetermined level, thereby preventing further losses. Traders can set stop-loss levels based on technical analysis, such as support and resistance levels, or use trailing stops to adjust to changing market conditions.

Portfolio Diversification Approaches

Portfolio diversification is another key risk management strategy, as it involves spreading investments across various assets to minimize exposure to any one particular market. In the context of crypto trading, diversification can involve investing in a range of cryptocurrencies, as well as allocating capital to different sectors or asset classes. By diversifying their portfolios, traders can reduce their reliance on a single asset and mitigate potential losses.

By incorporating these risk management strategies, traders can better navigate the complexities of crypto bull runs and protect their investments from significant losses.

Advanced Trading Strategies for Bull Market Conditions

As the crypto market continues its upward trend, the importance of sophisticated trading strategies cannot be overstated. Experienced traders understand that bull markets offer unique opportunities, but also come with increased complexity. To navigate this landscape effectively, traders must employ advanced techniques that can help maximize gains while managing risk.

Swing Trading During Uptrends

Swing trading is a popular strategy in bull markets, involving the purchase and sale of cryptocurrencies within a short-term price swing. This approach allows traders to capitalize on the upward momentum while minimizing exposure to market volatility. Effective swing trading requires a deep understanding of technical analysis, including chart patterns and momentum indicators.

Key elements of successful swing trading include:

- Identifying optimal entry and exit points

- Using technical indicators to gauge market sentiment

- Setting appropriate stop-loss orders to limit potential losses

Breakout Trading Tactics

Breakout trading is another advanced strategy that involves identifying key levels of support or resistance and capitalizing on the momentum when the price breaks through these levels. In a bull market, breakouts can lead to significant price movements, offering traders substantial profit opportunities.

To successfully implement breakout trading, traders should:

- Monitor trading volumes to confirm breakouts

- Use technical indicators to identify potential breakouts

- Set clear entry and exit strategies

Altcoin Rotation Strategies

Altcoin rotation involves shifting investments between different altcoins as they gain popularity and momentum in the market. This strategy requires a deep understanding of market trends and the ability to identify emerging opportunities. By rotating investments, traders can capitalize on the growth potential of various altcoins.

| Strategy | Description | Key Benefits |

|---|---|---|

| Swing Trading | Buying and selling within short-term price swings | Capitalizes on upward momentum, manages risk |

| Breakout Trading | Capitalizing on price movements after breaking key levels | Potential for significant profits, leverages market momentum |

| Altcoin Rotation | Shifting investments between altcoins based on market trends | Diversifies portfolio, captures growth potential |

By mastering these advanced trading strategies, traders can enhance their ability to navigate and profit from bull market conditions. Each strategy offers unique benefits and requires a specific set of skills and knowledge. As the crypto market continues to evolve, staying informed and adaptable is crucial for success.

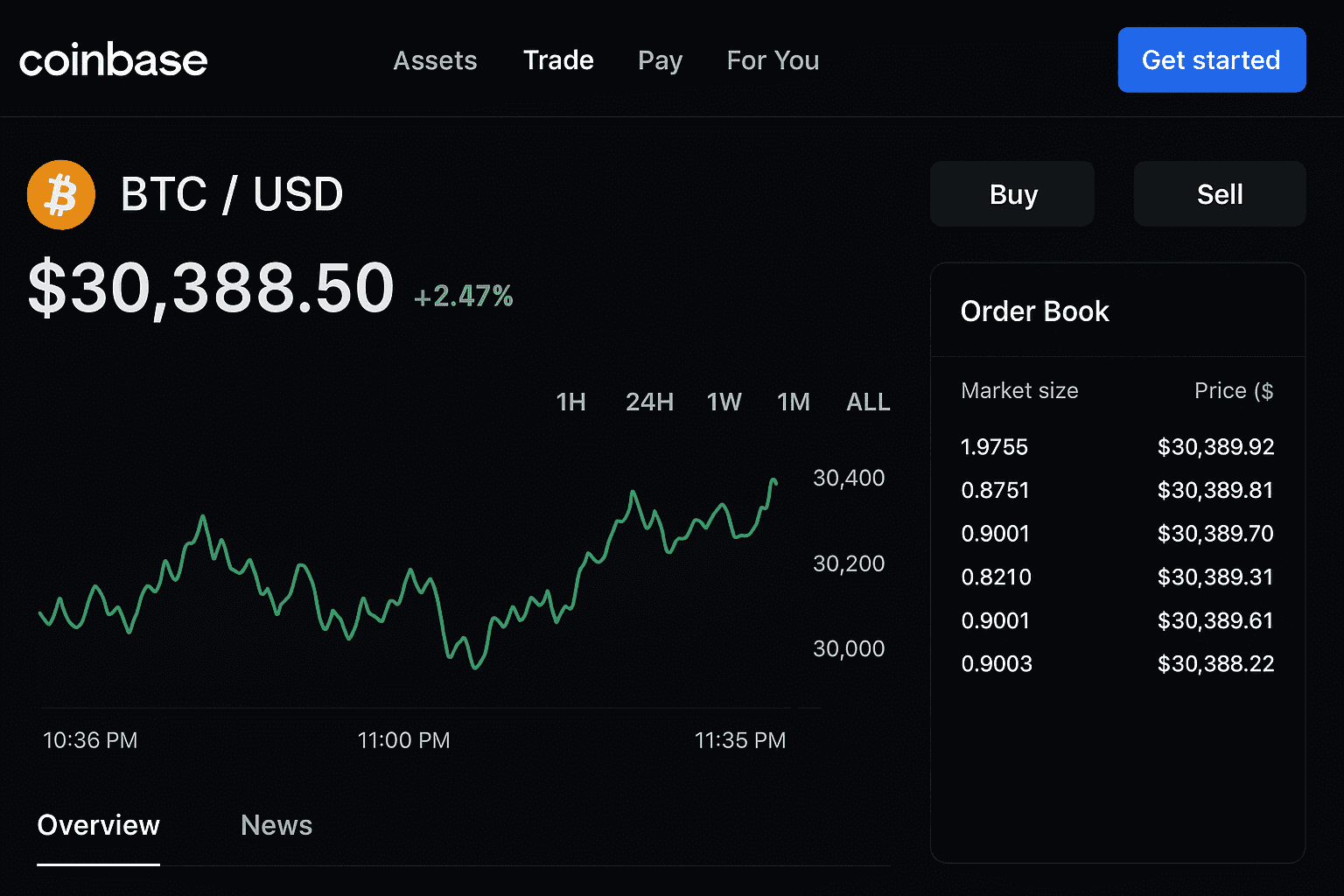

Bitcoin and Ethereum Analysis: Leading the Bullish Trend

Bitcoin and Ethereum are leading the charge in the ongoing crypto bull run, influencing market sentiment and investor decisions. Their performance not only affects their respective markets but also has a ripple effect on the broader cryptocurrency landscape.

Bitcoin Price Drivers in Bull Markets

Several key factors drive Bitcoin’s price during bull markets. These include increased institutional investment, improved market sentiment, and macroeconomic conditions that favor alternative assets. For instance, the recent surge in Bitcoin’s price can be attributed to its adoption by major financial institutions and its perceived value as a hedge against inflation.

“The growing involvement of institutional investors in Bitcoin has been a significant factor in its price appreciation, underscoring the cryptocurrency’s maturing status as an asset class.”

| Price Driver | Impact on Bitcoin Price |

|---|---|

| Institutional Investment | Increased demand, price appreciation |

| Market Sentiment | Positive sentiment boosts price |

| Macroeconomic Conditions | Favorable conditions increase appeal |

Ethereum Ecosystem Growth and Price Correlation

The growth of the Ethereum ecosystem, driven by the proliferation of decentralized finance (DeFi) applications and non-fungible tokens (NFTs), has a direct correlation with Ethereum’s price. As the ecosystem expands, it attracts more developers and users, thereby increasing demand for Ether and driving up its price.

Trading the Bitcoin-Altcoin Relationship

Understanding the relationship between Bitcoin and altcoins is crucial for navigating the crypto market. Typically, when Bitcoin’s price surges, it has a positive effect on the altcoin market, although some altcoins may outperform or underperform relative to Bitcoin. Traders often use this relationship to identify opportunities in the altcoin market based on Bitcoin’s price movements.

By analyzing the dynamics between Bitcoin, Ethereum, and altcoins, investors can make more informed decisions and potentially capitalize on the opportunities presented by the current bullish trend.

Preparing for the Anticipated 2025 Crypto Bull Run

With increasing adoption and technological advancements, the crypto market is expected to experience a bull run in 2025. As traders and investors prepare for this potential surge, understanding market cycle predictions and building a strategic trading plan are crucial.

Market Cycle Predictions and Analysis

Market cycle predictions suggest that the crypto market may follow historical patterns, with bull runs often driven by technological advancements and increased adoption. According to recent analysis, “the next crypto bull run could be driven by the increasing adoption of decentralized finance (DeFi) and non-fungible tokens (NFTs)”

.

Analyzing historical data, we can observe that crypto bull runs often occur in cycles. A detailed analysis of these cycles can provide insights into the potential drivers of the next bull run.

| Year | Bull Run Drivers | Market Trend |

|---|---|---|

| 2017 | ICO Boom | Significant Price Increase |

| 2021 | DeFi and NFT Adoption | Massive Market Surge |

Building a Strategic Trading Plan

To capitalize on the anticipated 2025 crypto bull run, traders need to build a strategic trading plan. This involves setting clear goals, understanding risk management, and identifying potential entry and exit points.

A strategic trading plan should include:

- Market analysis and trend identification

- Risk management strategies

- Entry and exit point identification

By building a comprehensive trading plan, traders can navigate the volatile crypto market with confidence.

Conclusion: Sustaining Success in the Volatile Crypto Landscape

Navigating the ever-changing crypto market requires a deep understanding of its dynamics and a strategic approach to trading. As discussed, a combination of technical analysis, fundamental analysis, and risk management is crucial for sustaining success in this volatile landscape.

Crypto market analysis plays a vital role in identifying opportunities and mitigating risks. By staying informed about market trends, project developments, and regulatory changes, traders can make informed decisions and adapt to the shifting market conditions.

To maintain a competitive edge, it’s essential to continuously refine trading strategies and stay up-to-date with the latest market analysis. By doing so, traders can effectively navigate the complexities of the crypto market and achieve long-term success.

In the volatile crypto landscape, sustaining success demands ongoing vigilance, strategic planning, and a commitment to staying informed. By adopting a proactive approach to crypto market analysis and trading, investors can maximize their potential for success.

FAQ

What are the key indicators of a bullish crypto market?

A bullish crypto market is characterized by increased trading volume, positive market sentiment, and a sustained upward trend in cryptocurrency prices.

How do active and passive trading strategies differ in a bullish crypto market?

Active trading involves frequent buying and selling to capitalize on short-term price movements, while passive trading involves holding onto investments for the long term, regardless of market fluctuations.

What technical analysis tools are essential for trading in a bullish crypto market?

Key technical analysis tools include chart patterns such as ascending triangles and cup and handle patterns, momentum indicators like the Relative Strength Index (RSI), and volume analysis to confirm uptrends.

How does fundamental analysis contribute to trading in a bullish crypto environment?

Fundamental analysis involves examining project development milestones, institutional adoption signals, and regulatory impact assessments to understand their influence on cryptocurrency prices and the overall bullish trend.

What are some effective timing strategies for navigating a bullish crypto market?

Effective timing strategies include identifying optimal entry points, using profit-taking methodologies, and avoiding the fear of missing out (FOMO) trap to maximize returns.

Why is risk management crucial during crypto bull runs?

Risk management is crucial to mitigate potential losses during market downturns, using techniques such as position sizing, stop-loss strategies, and portfolio diversification.

What advanced trading strategies can be employed during bull market conditions?

Advanced trading strategies include swing trading during uptrends, breakout trading tactics, and altcoin rotation strategies to capitalize on the bullish trend.

How do Bitcoin and Ethereum impact the overall crypto market during a bull run?

Bitcoin and Ethereum often lead the bullish trend, with their price movements influencing the broader market, and their ecosystems driving adoption and innovation.

What preparations should traders make for the anticipated 2025 crypto bull run?

Traders should analyze market cycle predictions, build a strategic trading plan, and stay informed about market trends to capitalize on the upcoming bull run.

What is the importance of continuous market analysis in a volatile crypto landscape?

Continuous market analysis is essential to adapt to changing market conditions, identify new opportunities, and mitigate potential risks in the volatile crypto landscape.

How can traders sustain success in a bullish crypto market?

Traders can sustain success by staying informed, adapting to market changes, and employing effective trading strategies, risk management, and analysis to maximize their returns.