Coinbase Exchange: Trade Crypto with Confidence

Coinbase Exchange: Trade Crypto with Confidence

Coinbase Exchange: Trade Crypto with Confidence

Are you ready to dive into the world of cryptocurrency but unsure about where to start? With the crypto market’s volatility and security concerns, choosing the right platform is crucial.

The Coinbase Exchange has emerged as a trusted name in digital currency trading, known for its secure trading platform and user-friendly interface. According to recent reviews, users have praised its efficient transactions and good customer support, making it a preferred choice for both novice and experienced traders.

As the crypto market continues to evolve, having a reliable cryptocurrency exchange is vital. The platform supports a wide range of cryptocurrencies, providing users with diverse digital currency trading options.

Key Takeaways

- Efficient transactions and good customer support

- Supports a wide range of cryptocurrencies

- Robust security measures for secure trading

- User-friendly interface for novice and experienced traders

- Reliable platform for buying, selling, and trading digital assets

Understanding Coinbase Exchange: A Comprehensive Overview

With its robust infrastructure and user-centric approach, Coinbase Exchange is redefining cryptocurrency trading. As a leading platform, it has garnered significant attention for its commitment to security, compliance, and user experience.

The Evolution of Coinbase in the Cryptocurrency Market

Coinbase has undergone significant transformation since its inception, adapting to the ever-changing cryptocurrency landscape. Initially focused on providing a simple way to buy and sell cryptocurrencies, it has expanded its services to become a comprehensive exchange.

Key milestones in its evolution include:

- Expansion of supported cryptocurrencies

- Introduction of advanced trading features

- Enhanced security measures

- Regulatory compliance across various jurisdictions

Key Features That Set Coinbase Exchange Apart

User-Friendly Interface for Beginners

Coinbase Exchange boasts an intuitive interface designed to facilitate easy navigation for new users. The platform’s layout is clean and straightforward, making it simple for beginners to start trading cryptocurrencies.

Regulatory Compliance and Licensing

A significant factor contributing to Coinbase’s credibility is its adherence to regulatory requirements. The exchange holds necessary licenses to operate in various jurisdictions, ensuring a secure and compliant trading environment.

Benefits of regulatory compliance include:

- Enhanced user trust

- Protection against illicit activities

- Operational stability

Getting Started with Coinbase Exchange Trading

Trading on Coinbase Exchange begins with creating an account and verifying your identity. This initial step is crucial for complying with regulatory requirements and securing your transactions.

Creating and Verifying Your Coinbase Account

To create a Coinbase account, you’ll need to provide some personal information and follow a verification process. This involves:

Identity Verification Requirements

Coinbase requires users to verify their identity to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. You’ll need to provide a valid government-issued ID and, in some cases, proof of address.

Linking Payment Methods

After verifying your identity, you’ll need to link a payment method to your Coinbase account. This can be a bank account, credit card, or debit card, depending on the available options in your region.

Navigating the Coinbase Exchange Interface

Once your account is set up and verified, you can start exploring the Coinbase Exchange interface. The platform is designed to be intuitive, with easy access to trading features, account settings, and market data.

Setting Up Two-Factor Authentication for Enhanced Security

To add an extra layer of security to your account, it’s highly recommended to set up two-factor authentication (2FA). This feature requires you to enter a unique code sent to your mobile device or generated by an authenticator app, in addition to your password.

| Security Feature | Description | Benefit |

|---|---|---|

| Two-Factor Authentication | Requires a unique code in addition to your password | Enhanced account security |

| Identity Verification | Validates user identity through government-issued ID | Compliance with regulatory requirements |

| Secure Payment Processing | Links payment methods to your account | Facilitates easy transactions |

Coinbase Exchange Trading: Platform Features and Capabilities

Coinbase Exchange offers a comprehensive trading platform with a range of features designed to cater to both novice and experienced traders. The platform is designed to provide a seamless trading experience, with a variety of tools and features that support different trading strategies. As a leading cryptocurrency exchange, Coinbase Exchange is committed to delivering a robust and reliable trading environment.

Supported Cryptocurrencies on Coinbase Exchange

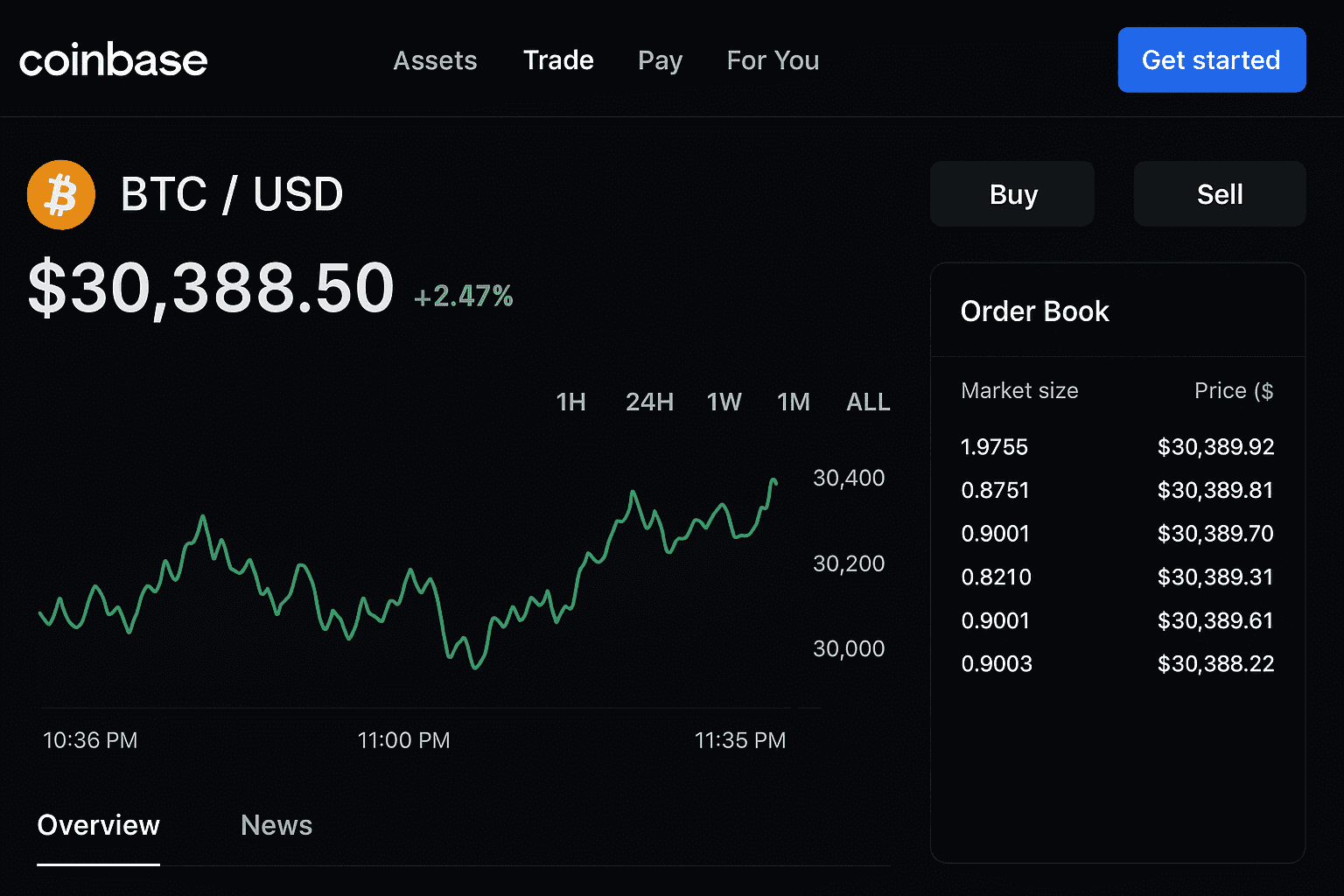

Coinbase Exchange supports a diverse list of cryptocurrencies, allowing users to trade a wide range of digital assets. The platform lists major cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, as well as other prominent altcoins. This extensive selection enables traders to diversify their portfolios and capitalize on various market opportunities.

Different Order Types Available

The Coinbase Exchange platform offers various order types to give traders flexibility in managing their trades. These include market orders, limit orders, and stop orders, each designed to meet different trading needs. By understanding the different order types, traders can make informed decisions and execute their trading strategies effectively.

Market Orders vs. Limit Orders

Market orders allow traders to buy or sell a cryptocurrency at the current market price, ensuring immediate execution. In contrast, limit orders enable traders to set a specific price at which they want to buy or sell, offering more control over the trade. According to a recent statement by a cryptocurrency expert, “Limit orders can be particularly useful in volatile markets, as they allow traders to capitalize on favorable price movements.”

“The key to successful trading is not to predict the market, but to react to it.”

Stop Orders and Advanced Options

Stop orders are used to limit potential losses or lock in profits by automatically executing a trade when a specified price is reached. Coinbase Exchange also offers advanced options, including stop-limit orders, which provide additional flexibility for experienced traders. These advanced features enable traders to implement complex trading strategies and manage their risk exposure.

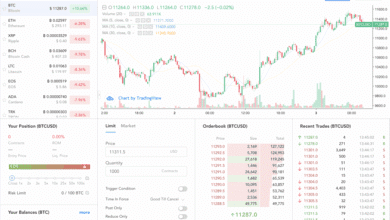

Advanced Trading Features for Experienced Users

For experienced traders, Coinbase Exchange provides advanced trading features that enable more sophisticated trading strategies. These features include advanced charting tools, real-time market data, and customizable trading interfaces. By leveraging these advanced features, experienced traders can optimize their trading performance and stay ahead of the market.

- Advanced charting tools for in-depth market analysis

- Real-time market data for timely trading decisions

- Customizable trading interfaces for personalized trading experiences

Buying and Selling Popular Cryptocurrencies

With Coinbase Exchange, users can easily engage in the buying and selling of prominent digital assets. The platform is designed to facilitate smooth transactions, making it accessible for both novice and experienced traders to navigate the cryptocurrency market.

How to Buy Bitcoin on Coinbase Exchange

Buying Bitcoin on Coinbase Exchange is a straightforward process. Users can quickly purchase Bitcoin using various payment methods supported by the platform. To start, simply create an account, deposit funds, and place an order for Bitcoin.

Trading Ethereum and Other Major Altcoins

In addition to Bitcoin, Coinbase Exchange allows users to trade Ethereum and other major altcoins. The platform supports a range of cryptocurrencies, enabling users to diversify their portfolios. To trade Ethereum or other altcoins, users can follow a similar process to buying Bitcoin, ensuring a seamless experience.

Converting Between Different Cryptocurrencies

Coinbase Exchange also facilitates the conversion between different cryptocurrencies, providing users with the flexibility to manage their digital assets effectively. This feature is particularly useful for traders looking to capitalize on market opportunities or adjust their investment strategies.

| Cryptocurrency | Minimum Trade | Fees |

|---|---|---|

| Bitcoin | $10 | 1.49% |

| Ethereum | $5 | 1.49% |

| Litecoin | $5 | 1.49% |

Security Measures on Coinbase Exchange

Coinbase Exchange prioritizes the security of user assets, employing a multi-layered approach to protect digital assets. This commitment to security is reflected in its robust infrastructure and user-focused safety features.

How Coinbase Protects Your Digital Assets

Coinbase employs several key measures to safeguard user assets.

Cold Storage Security Protocols

The majority of digital assets on Coinbase are stored in cold storage, which is not connected to the internet, thereby reducing the risk of hacking.

Insurance Coverage for Digital Assets

Coinbase also offers insurance coverage for digital assets stored on its platform, providing an additional layer of protection for users.

User-Level Security Best Practices

In addition to its platform-level security measures, Coinbase encourages users to adopt best practices for securing their accounts.

Password Management and Account Protection

Users are advised to use strong, unique passwords and enable two-factor authentication to enhance account security.

Recognizing and Avoiding Phishing Attempts

Coinbase also educates users on how to recognize and avoid phishing attempts, which are common tactics used by scammers to gain unauthorized access to user accounts.

Understanding Coinbase Exchange Fee Structure

Understanding the intricacies of Coinbase Exchange fees can help traders develop cost-effective strategies. The fee structure is a critical component of trading on the platform, impacting overall profitability.

Trading Fees Breakdown

Coinbase Exchange charges trading fees based on a tiered structure that considers the total trading volume over a 30-day period. Fees range from 0.50% for lower volume traders to 0.04% for those with higher trading volumes. It’s essential to review the current fee schedule as it is subject to change.

Deposit and Withdrawal Fees

Deposit and withdrawal fees on Coinbase Exchange vary depending on the payment method. For instance, bank transfers are generally free, while credit/debit card transactions incur a fee. Understanding these fees can help in choosing the most cost-effective payment methods.

Strategies to Minimize Trading Costs

To minimize trading costs, traders can utilize volume-based discounts by increasing their trading volume, thus lowering the fee percentage. Additionally, using Coinbase Pro can offer fee advantages, as it is designed for more advanced traders and provides a more cost-effective trading environment.

Volume-Based Discounts

Higher trading volumes qualify for lower fees, making it beneficial for active traders to increase their trading activity to reduce costs.

Coinbase Pro Fee Advantages

Coinbase Pro is tailored for professional traders, offering a fee structure that can significantly reduce trading costs for those who trade frequently.

Coinbase Exchange vs. Other Cryptocurrency Platforms

Coinbase Exchange has established itself as a leading cryptocurrency platform, but how does it stack up against the competition? The cryptocurrency market is populated with various exchanges, each offering unique features and benefits. To make an informed decision, it’s essential to compare Coinbase Exchange with other prominent platforms like Binance, Kraken, and Gemini.

Comparing Coinbase to Binance, Kraken, and Gemini

When evaluating Coinbase Exchange against its competitors, several factors come into play. Binance is known for its extensive range of supported cryptocurrencies and competitive fees. Kraken offers advanced trading features and robust security measures. Gemini emphasizes regulatory compliance and provides a secure trading environment. In contrast, Coinbase Exchange is renowned for its user-friendly interface and strong security protocols.

| Exchange | Supported Cryptocurrencies | Fees | Security Measures |

|---|---|---|---|

| Coinbase | Over 50 cryptocurrencies | Competitive, varies by transaction | Strong security protocols, insurance coverage |

| Binance | Over 200 cryptocurrencies | Low trading fees | Robust security, 2FA |

| Kraken | Over 100 cryptocurrencies | Varies by volume and type | Advanced security features |

| Gemini | Around 50 cryptocurrencies | Transparent, competitive | High regulatory compliance, strong security |

Advantages and Limitations of Coinbase Exchange

Coinbase Exchange offers several advantages, particularly in terms of security and compliance. Its robust security measures and adherence to regulatory requirements make it a trustworthy platform for users.

Strengths in Security and Compliance

Coinbase Exchange prioritizes the security of user assets, employing advanced security protocols and maintaining insurance coverage for digital assets held in its custody. Additionally, its commitment to regulatory compliance ensures that it operates within legal frameworks, providing users with a secure and reliable trading environment.

Considerations Regarding Fees and Cryptocurrency Selection

While Coinbase Exchange excels in security and compliance, considerations such as fees and the range of supported cryptocurrencies are also crucial. Coinbase charges fees that vary by transaction type and size, which can be a consideration for frequent traders. Moreover, although it supports a wide range of cryptocurrencies, the selection is not as extensive as some other platforms like Binance.

Mastering Cryptocurrency Trading on Coinbase Exchange

To excel in cryptocurrency trading on Coinbase Exchange, it’s crucial to understand the platform’s advanced features and trading strategies. Effective trading involves a combination of knowledge, experience, and leveraging the right tools available on the platform.

Essential Trading Strategies for Beginners

For those new to cryptocurrency trading, understanding basic trading principles is essential. Beginners should start by learning about market orders, limit orders, and stop orders. It’s also important to understand how to manage risk through position sizing and stop-loss orders. Starting with small trades and gradually increasing exposure as experience grows is a prudent strategy.

Using Coinbase Pro for Advanced Trading

Experienced traders can benefit significantly from using Coinbase Pro, which offers enhanced trading capabilities, including more advanced charting tools and lower fees for high-volume traders. Coinbase Pro provides a more sophisticated interface that caters to the needs of advanced traders. By leveraging features like customizable charts and technical indicators, traders can make more informed decisions.

Leveraging Market Data and Analytics

Market data and analytics play a crucial role in informed decision-making. Traders can use various tools and features on Coinbase Exchange to stay ahead of market trends.

Reading Charts and Technical Indicators

Understanding how to read charts and technical indicators is vital for identifying market trends and potential trading opportunities. Technical indicators such as Moving Averages, RSI, and Bollinger Bands can provide valuable insights into market dynamics. Traders should familiarize themselves with these tools to enhance their trading strategies.

Setting Up Price Alerts

Price alerts are a useful feature that allows traders to stay informed about market movements without constantly monitoring the markets. By setting up price alerts on Coinbase Exchange, traders can receive notifications when a cryptocurrency reaches a certain price, enabling them to react quickly to market changes.

“The key to successful trading is not just about making the right trades, but also about managing risk and staying informed.”

By mastering these aspects, traders can significantly improve their performance on Coinbase Exchange.

Customer Support and Resources for Traders

The Coinbase Exchange support infrastructure is designed to assist traders around the clock. This comprehensive support system is crucial for users who need help navigating the platform or resolving issues with their accounts.

24/7 Support Options and Response Times

Coinbase Exchange offers 24/7 customer support, ensuring that users can get assistance at any time. While response times may vary, the support team is accessible through various channels, providing users with flexibility and convenience.

Educational Resources and Trading Guides

In addition to support, Coinbase provides a range of educational resources and trading guides to help users enhance their trading knowledge and skills. These resources are designed to cater to both beginners and experienced traders.

Coinbase Learn Platform

The Coinbase Learn platform is a valuable resource that offers insights and information on various aspects of cryptocurrency trading. It helps users stay informed about market trends and best trading practices.

Community Forums and Support

Community forums and support play a crucial role in the Coinbase ecosystem, providing a space for users to connect, share experiences, and seek advice from other traders.

| Support Feature | Description | Availability |

|---|---|---|

| 24/7 Support | Round-the-clock assistance for users | Always Available |

| Coinbase Learn | Educational platform for trading insights | Available Online |

| Community Forums | Space for users to connect and share experiences | Available Online |

Conclusion: Is Coinbase Exchange Right for Your Trading Needs?

Coinbase Exchange is a robust platform that caters to a wide range of cryptocurrency trading needs. Its strong security measures, user-friendly interface, and comprehensive customer support make it an attractive choice for both new and experienced traders.

When evaluating Coinbase Exchange for your trading activities, consider the platform’s features and capabilities in relation to your individual trading needs. The exchange supports a variety of cryptocurrencies and offers advanced trading features, making it a versatile digital asset exchange.

By assessing your trading requirements and comparing them to the benefits and limitations of Coinbase Exchange, you can determine if this platform is the right fit for your cryptocurrency trading activities. As the cryptocurrency market continues to evolve, Coinbase Exchange remains a significant player, providing a secure and efficient trading environment.

FAQ

What is Coinbase Exchange and how does it work?

Coinbase Exchange is a leading cryptocurrency trading platform that allows users to buy, sell, and trade digital assets in a secure and reliable environment. It supports a wide range of cryptocurrencies and provides a user-friendly interface for both novice and experienced traders.

How do I create and verify my Coinbase Exchange account?

To create and verify your Coinbase Exchange account, you need to provide identification documents to comply with regulatory requirements and link a payment method to facilitate transactions.

What security measures does Coinbase Exchange have in place?

Coinbase Exchange implements robust security measures, including cold storage security protocols, insurance coverage, and two-factor authentication, to protect user assets and ensure a secure trading environment.

What types of orders are available on Coinbase Exchange?

Coinbase Exchange offers different order types, including market orders, limit orders, and stop orders, giving users flexibility in managing their trades.

How do I minimize trading costs on Coinbase Exchange?

To minimize trading costs on Coinbase Exchange, you can take advantage of volume-based discounts, which reduce fees for higher transaction volumes, and consider using Coinbase Pro, a more cost-effective trading environment designed for advanced traders.

Can I trade multiple cryptocurrencies on Coinbase Exchange?

Yes, Coinbase Exchange supports a diverse list of cryptocurrencies, allowing users to trade various digital assets, including Bitcoin, Ethereum, and other major altcoins.

How do I convert between different cryptocurrencies on Coinbase Exchange?

Coinbase Exchange enables the conversion between different cryptocurrencies, providing a convenient way for users to manage their portfolios and capitalize on market opportunities.

What are the fees associated with depositing and withdrawing funds on Coinbase Exchange?

Deposit and withdrawal fees on Coinbase Exchange vary depending on the payment method used, and users should review the fee structure to understand the costs associated with their transactions.

How does Coinbase Exchange compare to other cryptocurrency platforms?

Coinbase Exchange stands out for its strong security measures and regulatory compliance, making it a trustworthy choice for users. Compared to platforms like Binance, Kraken, and Gemini, Coinbase Exchange offers a unique balance of features and benefits.

What kind of customer support does Coinbase Exchange offer?

Coinbase Exchange provides 24/7 customer support, with a range of educational resources and trading guides available to help users enhance their trading knowledge and skills.

What is Coinbase Pro, and how does it differ from the standard Coinbase Exchange?

Coinbase Pro is a more advanced trading platform designed for experienced traders, offering enhanced trading capabilities, more complex trading strategies, and a more cost-effective trading environment.

How can I stay informed about market movements on Coinbase Exchange?

Users can leverage market data and analytics on Coinbase Exchange to stay informed about market trends, including reading charts and technical indicators, and setting up price alerts.